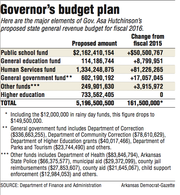

Gov. Asa Hutchinson proposed a general revenue budget for fiscal 2016 that would increase state spending by $149.5 million to nearly $5.2 billion with most of the increased state funds going to the public schools, human-service programs and prisons.

RELATED ARTICLES

http://www.arkansas…">Panel backs tax cuts, capital-gains cushion http://www.arkansas…">Bill to scrap youth health-services survey delayed http://www.arkansas…">Legislative summary http://www.arkansas…">Calendar

The Republican governor's proposed budget would increase general-revenue state spending by 3 percent in the fiscal year starting July 1.

The budget factors in the projected $12.8 million reduction in state tax revenue in fiscal 2016 from the Senate-approved Bill 6 that includes Hutchinson's income- tax rate cuts for Arkansans with taxable incomes ranging from $21,000 and $75,000 and repealing capital-gains tax cuts enacted in 2013.

Hutchinson said the House Revenue and Taxation Committee added an amendment to SB6 on Tuesday that would reduce state tax revenue by $10 million more a year than his budget anticipates and state lawmakers and officials will review possible cuts to the proposed budget.

The governor said his proposed budget is conservative and provides good tax cuts that constrain the growth of state government, while not putting the state's balanced budget at risk.

"I would have liked to have a more conservative budget in terms of the spending side," he told reporters in the Governor's Conference Room. "Most of the savings in the future are from programmatic changes, which could be in the large Medicaid budget, but it takes more than a year or 18 months to realize the savings from programmatic changes," he said.

Hutchinson also submitted a proposed fiscal 2017 budget that would increase state spending by $173.7 million to $5.37 billion with most of the increased funding going to the public schools, human-service programs and prisons. The proposed fiscal 2017 budget factors in an $80.6 million reduction in state general revenue from the Senate-approved version of SB6.

The 90th General Assembly will consider adopting a state budget for fiscal 2016 in this year's regular session; it will consider setting a state budget for fiscal 2017 in next year's fiscal session.

Legislative leaders praised Hutchinson's proposed state budget.

"I think it is a great starting point for us as we begin the budget process," said House Speaker Jeremy Gillam, R-Judsonia. "I think he laid out a very responsible budget that met the needs of our state and gave us a good foundation to build off of."

Senate President Pro Tempore Jonathan Dismang, R-Searcy, said, "I don't see any major disagreements at this point."

But state Sen. Bryan King, R-Green Forest, said that "we need to be making substantial reductions back in state spending and changing a lot of policy that stops spending other places, because we need to be preparing for an economic downturn."

Larry Walther, director of the state Department of Finance and Administration, said Hutchinson's proposed budgets are based on the general-revenue forecast released by former Democratic Gov. Mike Beebe's administration in November because "the basic economic assumptions used have not changed."

The proposed budget "provides for the needs of K-12 education meeting the adequacy requirements of the Arkansas constitution [and] funding is ensured for the state Medicaid program, looking for improvements going forward," he told the Joint Budget Committee. "The budget provides for the needs of prisons and community corrections programs for the protection of the public interest."

The budget includes a 1 percent cost-of-living raise for most state employees starting July 1, Walther said.

State Budget Administrator Brandon Sharp said the governor's proposed budget would use $157 million of the projected surplus of $215 million for "budget needs."

The governor proposed a $50.9 million increase to $2.12 billion in fiscal 2016 for general education. The increase in the Public School Fund comes after the Legislature's Educational Adequacy Committee's recommendations last fall, he said.

The governor also is proposing using $5 million in surplus funds for creating a computer science initiative grants program.

The governor's proposed budget would provide a $10 million increase in ongoing state general revenue to $44.2 million in fiscal 2016 and $6.5 million more in fiscal 2017 for school buildings and provides $40 million in surplus funds to provide for $65 million required for school building projects approved for the 2015-2017 biennium, Sharp said.

The budget blueprint provides an $81.3 million increase to the state Department of Human Services, raising it to $1.33 billion in fiscal 2016. It rises another $139.7 million to $1.47 billion in fiscal 2017. Sharp said the proposed budget helps meet the state's Medicaid program's funding requirements.

The governor also is proposing the use of $90 million in surplus funds to ensure sufficient funding for the Medicaid program, he said. About $2 million in tobacco settlement funds will be reallocated from the tobacco prevention and cessation program in the state Department of Health to the Medicaid program, he said.

The state Department of Correction's general-revenue budget would increase by $14.4 million to $336.7 million in fiscal 2016. That would include a $7 million increase for holiday and straight-time pay for department employees, a $4 million increase for food costs, and a $2 million increase for medical contract costs, Sharp said. The governor also will ask for supplemental funding of $11 million to catch up on the department's obligations to its employees, he said.

The governor's proposed budget would increase state general revenue for county jail reimbursement by $11.4 million to $27.9 million in fiscal 2016. The governor wants to increase the daily rate for county jail reimbursements from $28 to $30 per inmate and proposes allocating $1.9 million to fund that increase, Sharp said, adding the governor also proposes using $6 million in surplus funds for county jail reimbursements.

The state Department of Community Correction would receive a $1.6 million million increase in state general revenue to $78.6 million under the governor's proposed budget. The department will get $1 million more a year for drug courts, including veterans drug courts, and $300,000 more a year for re-entry programs, Sharp said.

Hutchinson told county sheriffs in the Governor's Conference Room that he's asked Department of Correction Director Wendy Kelley to come up with a couple of different options for solving the prison crowding problem.

"I've already seen one option. Instead of building a $100 million prison, we expand with existing space, but it still costs money and it is not a complete solution," he said. "I think we need to look at regional [facilities]."

Hutchinson said he's hoping that "we will have something by the end of the legislative session that we can bring back and address the prison overcrowding issue."

He said he also wants the state to hire more parole officers, provide alternatives to prison, hold parolees more accountable, have effective re-entry programs and use faith-based groups as part of his multifaceted plan to control prison crowding.

Sharp told lawmakers that the state's higher education institutions "will be held harmless from any cuts" in fiscal 2016 and 2017, as the governor has promised, as well as the state Department of Higher Education's scholarship programs. All other state agencies will have budget cuts, he said.

Afterward, Joint Budget Committee Co-Chairman Sen. Larry Teague, D-Nashville, said Hutchinson's proposed fiscal year 2016 budget is a fair and workable budget.

"I don't like using one-time [money] for ongoing operations. It is something we have been doing since the economic downturn," he said. "I don't like it, but I am just thankful we got [surplus funds]."

Joint Budget Committee Co-Chairman Rep. Lane Jean, R-Magnolia, said he thinks "we can live" with Hutchinson's proposed budget for fiscal 2016.

"The sky is not falling," Jean said, referring to some people who warned about the potentially dire consequences of Hutchinson's proposed income tax rate cut on the state budget.

The governor also is proposing using $40 million in surplus funds for the Governors' Quick Action Closing Fund and Amendment 82 super projects, Sharp said.

Amendment 82 allows the state to issue bonds for funding of infrastructure and other needs, such as land acquisition, site preparation and employee training.

Hutchinson said he left no surplus funds in his proposed budget for any General Improvement Fund projects for lawmakers or the governor.

"The priority should be on the overall budget needs of the state as well as the tax cut that is a priority," he told reporters. "While there is some very good GIF spending, that is not the highest state priority for this year."

Teague said he's told senators that he expects to have more discussions about not having General Improvement Fund monies for the Legislature.

"I just don't see that holding, but we'll see," he said.