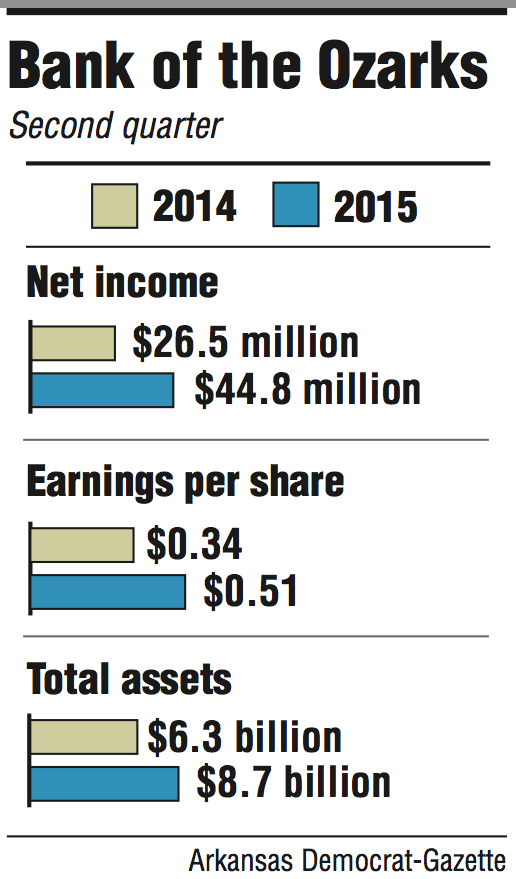

Bank of the Ozarks had net income of $44.8 million in the second quarter, the Little Rock-based bank said Monday.

That was up almost 70 percent from $26.5 million in the second quarter last year.

Bank of the Ozarks earned 51 cents per share for the quarter, matching the average estimate of 51 cents a share projected by 10 analysts surveyed by Thomson Reuters. In the second quarter last year, Bank of the Ozarks earned 34 cents per share, representing a 50 percent improvement.

George Gleason, Bank of the Ozarks' chairman and chief executive officer, was pleased with the results.

The bank's return on assets of 2.17 percent "builds on our track record of having achieved returns on average assets in excess of 2 percent in each of the last five years," Gleason said.

Return on assets -- profits as a percentage of assets -- above 1 percent is considered good by bankers, and exceeding 2 percent is considered exceptional.

Bank of the Ozarks had an efficiency ratio of 36.6 percent in the second quarter, an improvement over 44.6 percent in the second quarter last year. That means it costs Bank of the Ozarks $36.60 to earn $100.

The bank reported $4.8 billion in loans and leases not purchased through acquisitions in the second quarter, a 50 percent jump from $3.2 billion in loans and leases in the second quarter last year.

Bank of the Ozarks should continue its strong loan growth for the rest of the year, said Matt Olney, a banking analyst in Little Rock with Stephens Inc.

"On the [first-quarter] conference call in April, they talked about their loan pipeline and how strong it was," Olney said. "So we're optimistic that we'll see part of that in the second quarter."

Bank of the Ozarks also is likely to continue its string of acquisitions in the near future, Olney said. It has acquired 13 banks since 2010, including Bank of the Carolinas of Mocksville, N.C., which was announced in May.

But the bank could adjust the timing of some purchases if it needs to.

Olney said he expects Bank of the Ozarks to have about $9.9 billion in assets by the end of the year.

That is close to the $10 billion asset threshold, at which banks face increased regulatory scrutiny and costs.

"So banks try to manage this as well as they can," Olney said. "Bank of the Ozarks has been quite clear they are going to go over $10 billion in assets."

If Bank of the Ozarks were to pass $10 billion by the end of the year, it would incur the added regulatory costs in 2016. But if it passed that mark in early 2016, it wouldn't begin to incur those costs until 2017, Olney said.

Bank of the Ozarks was one of the best-performing bank stocks in the country through the first half of the year, Olney said.

Olney still rates Bank of the Ozarks as a buy. But several analysts recently have lowered their ratings of the bank from buy to hold. The likely reason for other analysts to lower their rating on Bank of the Ozarks was because the stock price has risen significantly, Olney said.

"If the bank's stock gets close to the price target, it makes it more difficult to justify their ratings," Olney said of the lowered ratings.

Bank of the Ozarks' executives will hold a conference call at 10 a.m. today to discuss the second-quarter results. To access the call, dial 888-771-4371.

Business on 07/14/2015