Fueled by better-than- expected individual income and sales and use tax collections, state general revenue in October totaled a record $490.4 million, an $11.8 million increase over what was taken in during the same month last year.

State forecasters had predicted revenue would be less than what was collected in October 2014, but last month's general revenue collections exceeded the state's forecast by $25.9 million, the state Department of Finance and Administration said Tuesday in its monthly revenue report.

October's collections are a record for the month, said department tax analyst Whitney McLaughlin. The previous record for October was the $478.6 million collected in October 2014, she said.

Republican Gov. Asa Hutchinson said that "October was the seventh consecutive month we saw an increase in our state's sales tax, which is a good indicator of consumer confidence and economic growth.

"This is a reassuring sign for Arkansans that our economy continues to move in the right direction," Hutchinson said in a written statement.

Individual income tax collections were better than expected in October largely as a result of payments by taxpayers who had received a six-month extension in April to file their returns, said finance department Director Larry Walther.

Individual income and sales and use taxes are state government's two largest sources of state general revenue.

"[The increased] consumption correlates with job growth and especially job growth in the higher-income categories of the economy, the core sectors," said John Shelnutt, the state's chief economic forecaster.

These sectors include construction; professional and business services; education and health; and finance; and they tend to be associated with more full-time jobs than the retail and food service sectors, Shelnutt said.

Arkansas' unemployment rate in September fell to 5.2 percent from 5.4 percent in August, the U.S. Bureau of Labor Statistics reported two weeks ago. It was the lowest unemployment rate in the state since May 2008, when it was 5.1 percent.

The national unemployment rate was 5.1 percent in September.

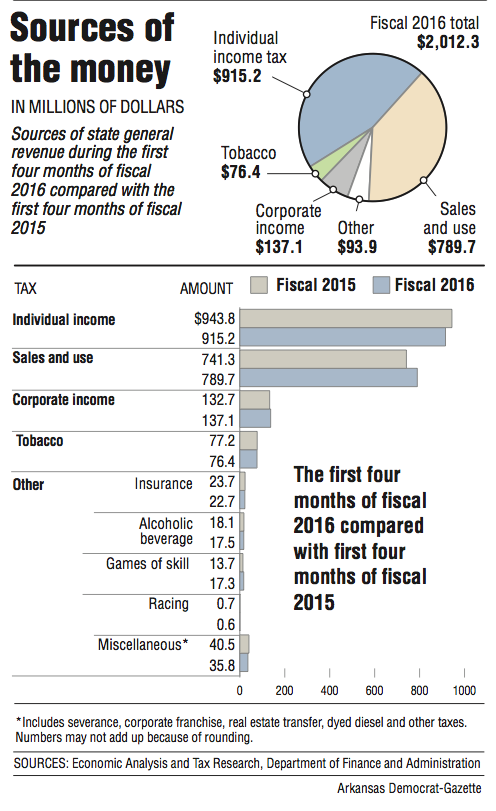

During the first four months in fiscal 2016, state general revenue increased by $20.5 million (1 percent) over the same period in fiscal 2015 to $2.012 billion. That's $66.6 million (3.4 percent) above the state's forecast. Fiscal year 2016 started July 1.

So far in fiscal 2016, individual income taxes dipped by $28.6 million (3 percent) over the same period in fiscal 2015 to $915.2 million, but they've exceeded the state's forecast by $26.6 million (3 percent).

"We have a $50 million [income] tax reduction that started in January, so you would expect it to be down a little," said Walther.

So far in fiscal 2016, sales and use taxes increased by $48.3 million (6.5 percent) over the same period in fiscal 2015 to $789.7 million. That's $33.7 million (4.5 percent) above the state's forecast.

State tax refunds and several other government expenditures come off the top of total general revenue, leaving "net" general revenue that agencies are allowed to spend.

During the first four months of fiscal 2016, the net revenue increased by $17.5 million (1 percent) over the same period in fiscal 2015 to $1.74 billion. That's $63.5 million (3.8 percent) above the state's forecast.

According to the finance department, October's general revenue included:

• A $3.7 million (1.6 percent) increase in individual income tax collections over a year ago to $233.8 million, exceeding the state's forecast by $18.5 million (8.6 percent).

Withholdings are the largest category of individual income tax collections. They declined by $7.3 million over a year ago to $183.8 million, but exceeded the state's forecast by $5.8 million.

Individual income tax collections from returns and extensions increased by $10.7 million over a year ago to $42.9 million, exceeding the state's forecast by $12.3 million.

Walther said individual income tax filers are allowed to seek a six-month extension from the April 15 deadline to file their returns and "when they actually filed in October, there was taxes due and that in part was the reason why were up $18.5 million [over the forecast] in October."

• A $9.6 million (5.2 percent) increase in sales and use tax collections over a year ago to $193.6 million, outdistancing the state's forecast by $6 million (3.2 percent).

"The results reflected continued growth in underlying economic indicators for consumption," the department said in its written report.

• A $1 million (3.4 percent) increase in corporate income tax collections over a year ago to $30.5 million, exceeding the state's forecast by $1.8 million (6.3 percent).

• A $1.9 million (9.2 percent) decline in tobacco tax collections from a year ago to $18.9 million, exceeding the state's forecast by about $300,000 (1.9 percent). Monthly changes in tobacco tax collections can be attributed to uneven patterns of tobacco stamp sales to wholesale purchasers.

Metro on 11/04/2015