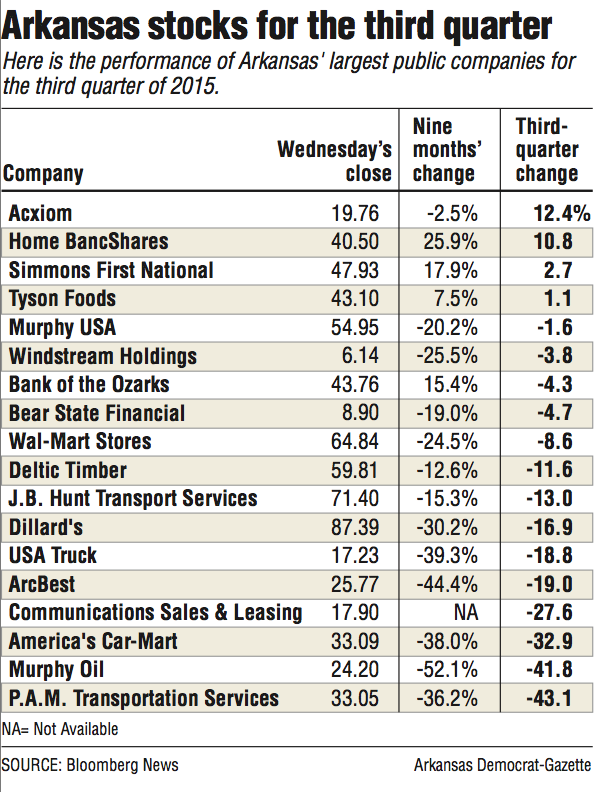

Even with a last-day rally, only four publicly traded Arkansas companies had gains in the third quarter, which ended Wednesday. Nine firms had double-digit losses for the period.

The Arkansas Index, which tracks the largest public companies based in the state, lost 14 percent for the quarter and is down more than 20 percent for the year.

Little Rock-based Acxiom rose 12.4 percent in the third quarter, the best performance of the 18 largest publicly traded companies.

"Investors, and ultimately Acxiom shares, have responded to efforts to realign the company as a subscription-based digital marketing entity from an information technology firm following the sale of its [information technology] outsourcing business," said Bob Williams, senior vice president and managing director of Simmons First Investment Group Inc. in Little Rock.

In May, Acxiom said it would sell its information technology infrastructure management business for $140 million in cash and up to $50 million in other payments. Acxiom will retain a 5 percent share of the business.

Conway-based Home BancShares was up almost 11 percent for the quarter.

"The company's use of acquisitions as growth and capital management strategies has been paying off for the company and its shareholders as well," Williams said. "Its ability to briskly convert purchases has resulted in rapid accretion and contributed to its record quarterly earnings for the second quarter of this year."

P.A.M. Transportation Services of Tontitown had the worst performance of the Arkansas stocks, falling more than 43 percent in the third quarter.

"Despite a statement by the company in July that it had the best quarter in its history from the perspective of operating profit, net income and earnings, its shares have failed to rebound," Williams said. "Even the combination of lower oil prices and a self-tender offer for their shares has not been enough to stop the skidding."

Murphy Oil of El Dorado fell almost 42 percent for the quarter.

"Despite plans by the company to cut capital expenditures and slash risk commitments for exploration wells, the shares have been battered by plummeting oil prices," Williams said. "The company's stated strategic interest in adding to its shale inventory has yet to be reflected in its share price."

America's Car-Mart of Bentonville lost almost 33 percent for the quarter.

"The domino effect impacted America's Car-Mart in the latest quarter," Williams said. "While sales were good, an increasing amount of the company's customers were unable to pay for their vehicles. The comments from the company indicated this was limited to a specific group of stores and that efforts were being made to address the issues."

For the first nine months of the year, three Arkansas banks have outperformed the state's other public companies.

Home BancShares was up 25.9 percent through September, Pine Bluff-based Simmons First National rose almost 18 percent and Bank of the Ozarks of Little Rock was third with a 15.4 percent gain through nine months.

Year-to-date, bank stocks nationally are flat this year, said Matt Olney, a banking analyst in Little Rock with Stephens Inc.

"It shows the strong quality these three Arkansas banks have," Olney said. "You're seeing that play out with the year-to-date performance of each one."

The common theme for the three is strong loan growth and the pursuit of acquisitions, Olney said.

This year, Home BancShares announced the purchase of Florida Business BancGroup of Tampa, as well as a $289 million loan portfolio from a Puerto Rico bank. Bank of the Ozarks announced the purchase of Bank of the Carolinas in Mocksville, N.C., this year.

"They are also getting good cost savings from the previous deals [the three banks] closed over the last few years," Olney said.

Even though the banks' stocks are doing well, that isn't guaranteed to continue for the rest of the year, Olney said.

"On a relative basis, [the Arkansas banks] are better positioned than others out there," Olney said. "Some banks are very rate sensitive, meaning they will do very well with higher rates. So if the [Federal Reserve] were to come out tomorrow with some pretty bullish comments about rates, these guys would underperform those other banks out there that are more rate sensitive."

But over the long term, Olney expects the three Arkansas banks' stocks to do well.

Business on 10/01/2015