Four of the largest banks in Arkansas are so profitable that they are masking the overall profitability of the state's banking industry, an executive with the Federal Reserve Bank of St. Louis said last week.

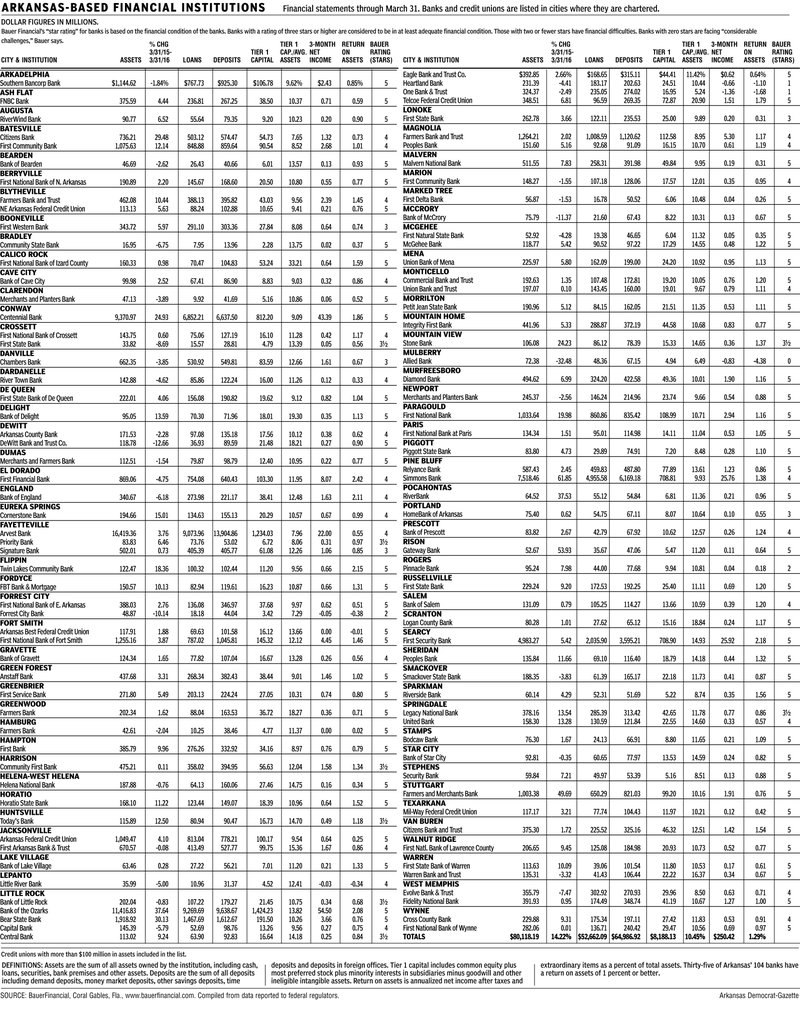

The 104 banks in Arkansas have a combined average return on assets -- which is net income as a percentage of assets -- of 1.29 percent, a healthy indicator.

Banks with a return on assets of 1 percent or higher are considered to be performing well. Only a third of the state's banks have a return on assets of 1 percent or better.

But if four banks -- Bank of the Ozarks of Little Rock, Centennial Bank of Conway, First Security Bank of Searcy and Simmons Bank of Pine Bluff -- are removed from the equation, the other 100 banks in the state have a return on assets of only 0.89 percent, said Julie Stackhouse, senior vice president with the St. Louis bank.

Bank of the Ozarks earned about $55 million, Centennial about $43 million, First Security about $26 million and Simmons about $26 million in the first quarter. If Arvest Bank of Fayetteville, which made $22 million, is included, the remaining 99 banks earned only about $78 million in the first quarter.

"We know a few banks in Arkansas are really generating a lot of profits," Stackhouse said.

What that highlights, Stackhouse said, is the challenge smaller banks in Arkansas are facing to generate profits.

"Community banks will need to find a way to continue to be profitable even though their [size] is really starting to become a factor," Stackhouse said.

Still, banks in Arkansas generally are doing well, said Garland Binns, a Little Rock banking attorney.

"I believe banks in Arkansas are performing comparably with banks in other states," Binns said.

Banks nationally have a return on assets of almost 1 percent, according to the Federal Deposit Insurance Corp.

There are other issues also impacting community banks, Stackhouse said.

The extended low interest rates environment is a challenge to relatively small community banks, she said.

The cost of meeting regulatory requirements is higher, she said. And banks are having a difficult time attracting high-quality management to their towns who can lead the bank in the future, she said.

"It makes it incredibly important that the board of directors and their leadership team plan for how to address the challenges in the years ahead," Stackhouse said. "Ideally building a pipeline of talent is the most effective way to address these challenges."

A year from now, there won't be much discernible difference, because changes are moving so slowly, Stackhouse said.

"But the board must understand that succession needs to exist and that that is part of the responsibility of a board," Stackhouse said. "Honestly, though, that's still tough. We've seen for many decades that family members often would move into leadership roles. That's not as common today so that makes the job of that board of directors even more difficult."

The St. Louis bank has concerns about some current lending practices nationally, Stackhouse said. Regulators are monitoring commercial real estate lending closely, she said.

"There has been a pretty quick ramp-up in [commercial real estate loans]," Stackhouse said. "We want to be sure that a couple things are occurring."

One concern is that a bank's board of directors and management team consider how the bank is underwriting these loans, conservatively or aggressively, Stackhouse said. Secondly, regulators are asking boards where banks are aggressively increasing commercial real estate loans to determine how much risk will be allowed, she said.

Binns noted that the FDIC released a report recently that also indicated there was a concern about the volume of commercial real estate loans.

"What they are saying is that the risk is there [for something to go wrong]," Binns said. "For instance, if there was a change in the economy in a region, that might impact the performance of some of those loans."

SundayMonday Business on 06/19/2016