WASHINGTON -- President Barack Obama said Congress should pass legislation to rebuild U.S. infrastructure, raise the minimum wage and crack down on money laundering and tax evasion, after his administration released a plan to make it harder for people to hide money in the U.S.

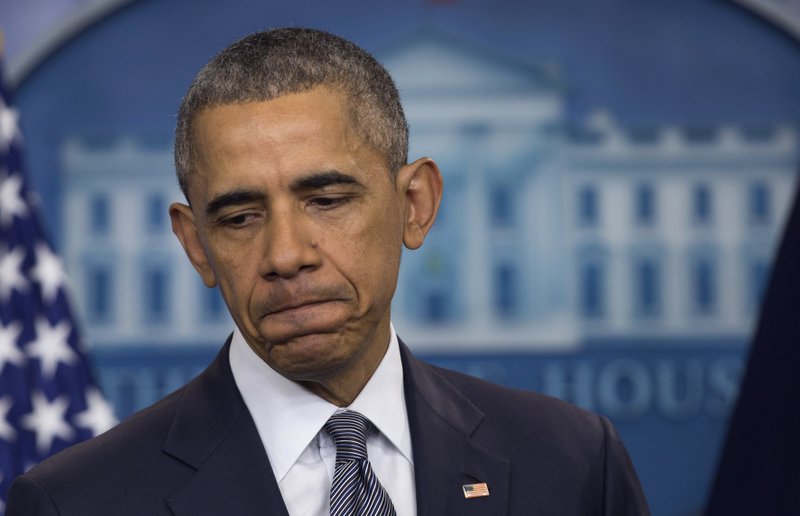

"If the Republican Congress joined us to take some steps that are common sense, we could put some additional wind behind the backs of hardworking Americans," Obama said.

Obama's comments came the same day the Labor Department reported that U.S. employers added 160,000 jobs in April, the lowest amount in seven months.

The Obama administration has downplayed signs of a slowdown in the U.S. economy, instead blaming Congress for blocking proposals the administration says would spur more economic growth. Those include spending more money on infrastructure improvements, which Obama said would create jobs as well as "huge multiplier effects across the economy," and a minimum wage increase.

On Thursday, the administration announced plans to capitalize on global concern about financial secrecy in offshore shell companies prompted by a massive document leak, the so-called Panama Papers, by proposing changes in U.S. laws and regulations to increase transparency and decrease abuses of the banking system.

The administration has proposed legislation to require companies to disclose the names of owners of any new entities they create. Obama said the regulatory changes would "make sure foreigners cannot hide inside anonymous shell companies formed within the United States."

"In recent months we've seen just how big a problem corruption and tax evasion have become around the globe," Obama said Friday at the White House, as he promised to continue an effort "to make sure that the rules aren't rigged and our economy works for everybody."

The president spoke a day after the Treasury Department announced two new measures aimed at forcing companies to better track and disclose ownership to the IRS.

One, the so-called customer due diligence rule, was finalized Thursday after four years' consideration. The rule dictates how banks keep records on who owns the companies that use their services.

A second proposed rule would close a loophole that allows a narrow class of foreign-owned companies to avoid reporting to the IRS.

As the Treasury Department announced the regulations, Secretary Jacob Lew wrote to Congress urging lawmakers to go further. Lew said congressional action was needed to give law enforcement tools "to combat bad actors who seek to hide their financial dealings and evade their tax responsibilities."

The department sent new draft legislation to Congress that would require companies to know and disclose their owners to the IRS and to allow law enforcement to access that information. And he called on Congress to pass legislation that would require U.S. banks and other financial institutions to collect and disclose more detailed information about foreign account holders -- information it requires foreign banks to collect about Americans.

Obama and Lew also urged lawmakers to ratify eight tax treaties that have languished in the Senate. The Senate Foreign Relations Committee approved the treaties in November.

Obama said the treaties would improve law enforcement's ability to pursue tax dodgers hiding assets abroad by enabling cooperation with foreign governments. Treaties cannot go into force unless ratified by the Senate, and the objection of any one senator halts action on legislative business pending in that house of Congress.

He pointed to Sen. Rand Paul, R-Ky., as holding up the treaties.

"I'm calling on the Senate, in particular Sen. Rand Paul, who's been a little quirky on this issue, to stop blocking the implementation of tax treaties that have been pending for years," Obama said at the White House. "These treaties actually improve law enforcement's ability to investigate and crack down on offshore tax evasion. And I'm assuming that's not something that he's in favor of."

Paul has said he opposes the agreements for privacy reasons, saying they would let governments collect and share citizens' financial information.

In a November 2015 letter to Senate Majority Leader Mitch McConnell, Paul said he doesn't condone tax cheats but can't support a law that endangers legal foreign investment and "punishes every American in pursuit of a few tax cheats."

"An individual's bank account is the epitome of who they are as a private citizen," Paul wrote McConnell, a fellow Kentucky Republican, adding that the account can reveal where someone shops, where they eat, what medicines they take, who their doctors are and where they travel. "Bulk collection tax treaties are not a policy prescription to U.S. citizens conducting illicit financial transactions in a foreign country."

Paul's office had no immediate comment Friday.

Information for this article was contributed by Angela Greiling Keane, Margaret Talev and Shobhana Chandra of Bloomberg News; and by Kathleen Hennessey and Darlene Superville of The Associated Press.

A Section on 05/07/2016