Tyson Foods Inc. topped expectations in the second quarter, typically the most difficult for the company because of its timing after the holiday season and before summer grilling, with a strong performance in the company's chicken sector.

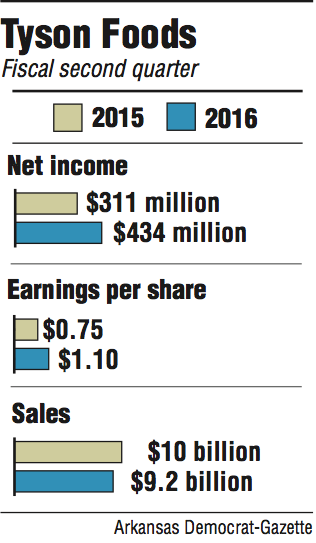

Springdale-based Tyson reported a net income of $434 million, a 39 percent increase from $311 million during the same quarter last year. Analysts expected revenue to fall to $9.04 billion, but the company booked revenue of $9.2 billion, a decrease of 8 percent compared to the second quarter of 2015.

"We're in a great position, and we're generating momentum that will take us into 2017 and beyond," said Donnie Smith, Tyson's chief executive. "We've produced record results in the first half of the fiscal year, and we expect continued strong performance in the second half."

Tyson raised its earnings guidance for the year to $4.20 to $4.30 per share. Before Monday's report, Tyson had already forecast record earnings.

Growing demand for chicken helped drive the number of sales in the sector. Coupled with falling feed costs, the high demand increased operating income for chicken to $347 million, up from $332 million during the same time last year. Feed costs decreased $80 million for the second quarter and $140 million for the first and second quarter combined.

Over the past five years, Tyson has diversified its chicken business to add more value-added and branded products, creating higher and more stable margins, Smith said.

"We've diversified our pricing mechanisms," he said. "We've optimized our cost structure by investing in our operations with good return on investment projects."

Bob Williams, senior vice president and managing director of Simmons First Investment Group Inc. in Little Rock, said Tyson has been trying to insulate its bottom line from commodity prices by diversifying its chicken business.

"This company has continued to push away from the commodity side of the chicken industry," he said. "They've done a good job of diversifying themselves out and of convincing analysts that they are not just subject to the whims of the commodity price of chicken."

Tyson continues to look to China and India, as well as the company's prepared food sector, to drive its growth in the coming years. Smith said the international team is working on producing value-added products that can counter soft chicken prices in China.

"They're making good headway," he said. "They're only seeing momentum."

Maryland-based Perdue Farms announced last month that it would push into organic chicken production, a growing market as consumers start to favor meat grown in ways they perceive as more natural.

Smith said that Tyson already sells some lines of organically raised chicken, but he isn't discounting additional organic production.

"We'll continue to focus on the consumer, and whether it's no antibiotics ever or natural offerings, organics, whatever it may be, we're going to be a consumer-led company and we'll respond accordingly," he said.

Tyson stock price per share increased 1.47 percent to close at $68.24 in trading Monday on the New York Stock Exchange. Earnings were released before the markets opened on Monday.

Business on 05/10/2016