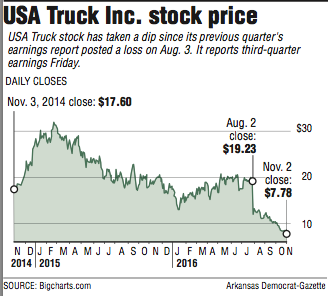

Since USA Truck announced a $1.3 million loss for its second quarter on Aug. 3, its stock price has dropped by more than half.

The Van Buren company has dealt with management and operations challenges and high leadership turnover in recent years. CEO Randy Rogers is the company's fourth leader in three years.

Notably, Knight Transportation attempted a hostile takeover bid in 2013, offering $9 per share, 35 percent lower than share value at the time. Liberate Technologies, a Silicon Valley-based software company had previously offered $21 per share for the company in 2006, and Celadon, an Indianapolis trucking company, also attempted a merger in 2012.

Since then, USA Truck stock seemed to stabilize, with prices topping $31 in early 2015, until this year's second-quarter report. Its third-quarter report is expected Friday.

The day of the second-quarter release, the share price dropped 23 percent, from $19.23 to $14.69, and on Aug. 4 the price closed at $11.19. The price hit a three-year low on Wednesday, closing at $7.78.

"The biggest surprise and contributing factor of the stock decline is a result of the change in outlook related to the company's financial performance," said Brad Delco, transport analyst for Stephens Inc. " [USA Truck] posted a negative surprise with its second-quarter results, as analysts expected the company to earn 19 cents a share, and they lost 10 cents a share."

Delco said most investors use "financial metrics" to determine the current worth of a stock in a company. "All those metric values are based off of financial performance or even the forecasted financial performance of a company. Given the big negative surprise, everyone's forecast got adjusted lower from Wall Street's perspective."

Stephens has estimated a 4 cents earnings per share for USA Truck's third quarter. Stifel Financial Corp. predicts flat earnings per share. Four analysts polled by Yahoo Finance are predicting an average of 9 cents per share.

Craig Rennie, associate professor of finance of the Walton College of Business at the University of Arkansas at Fayetteville, cautioned about putting too much weight on a response to one earnings report.

"It's common that you're going to have stock price reactions to negative news," Rennie said. "Stocks basically are priced based on expectations of future cash flows."

Rennie said the market responds in the context of the totality of the situation, not just one earnings statement, including other SEC filings, public news announcements, analyst analysis and the broader state of the trucking industry.

"So, the fact that the stock may have dramatically fallen is not unusual and underscores why most investors should be diversified and thus not overly exposed to the bad fortunes of a specific company," he said.

"The bottom line here is, I wouldn't put too much emphasis on one individual earnings announcement and forecast," Rennie said. "But I would consider it among all the other information available on this particular stock."

In the company's second-quarter earnings call, CEO Rogers said that it "wasn't the quarter that we anticipated nor wanted to report." He concluded on a positive note: "We clearly have a great team in place. We are improving the fundamentals of business in large ways and small, and we are on the right track."

In a research note, John Larkin, an analyst at Stifel Financial, pointed out that while Rogers and his two colleagues, Jim Craig, president of the logistics segment, and Martin Tewari, president of the trucking segment, have "substantial transportation logistics experience," they have been at USA Truck only for a short time. The company just appointed a new chief financial officer this month, a post that had been vacant since May.

Larkin added that while Stifel doesn't "question management's ability as operators," it does question whether the broader economic climate can maintain a stable environment for them "to substantially ramp up within the company's internal operations and systems to effectively steer the ship and navigate through growth (or in this case, tough waters)."

Business on 11/03/2016