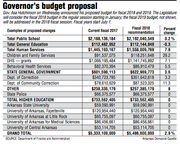

Gov. Asa Hutchinson on Wednesday presented lawmakers with his proposed general-revenue budget of $5.48 billion for the next fiscal year, a $153 million increase in which most of the additional money would go to the state Department of Human Services.

The Republican governor also said he would ask the Legislature, which convenes Jan. 9, to enact a tax cut that would become effective in the last half of fiscal 2019. The tax cut, taking effect on Jan. 1, 2019, would reduce general revenue by $25 million in fiscal 2019 and by $50 million a year thereafter. He prefers an income tax cut but hasn't made a decision.

The state now is in fiscal 2017, which started July 1. In the session that starts in January, the Legislature will make budgeting decisions about fiscal 2018, which starts July 1, 2̶0̶1̶8̶ 2017*.

"This budget meets the needs of our state, maximizes the opportunity for economic growth and continues to emphasize efficiencies, reform and savings," Hutchinson told lawmakers during pre-session budget hearings at the Capitol.

He said his proposal "reflects a necessary and cautious and conservative approach to tax cuts.

"The state budget has fully absorbed the landmark $100 million [income] tax cut, and individual income taxes continue to be strong, but we continue to monitor the sales tax collections in trying to determine why they are not robust," Hutchinson said.

Larry Walther, director of the state Department of Finance and Administration, said state tax collections rebounded last month and "provided encouragement going forward.

"We will continue to monitor the collections and make adjustments if they are required," he said.

The $100 million-a-year tax cut was enacted in 2015 for Arkansans with incomes between $21,000 and $75,000 a year.

Hutchinson said his priority for the proposed $50 million-a-year tax cut would be to reduce income-tax rates on Arkansans. He said he'll release the details of his proposed tax cut before the 2017 session and he's "looking forward to working with the General Assembly as you consider my ideas as well as other ideas on the table."

Senate President Pro Tempore Jonathan Dismang, R-Searcy, said in an interview that Hutchison's proposed budget for fiscal 2018 is "tight."

Most of the increased funding that Hutchinson proposes to distribute to state agencies "looks like items that really aren't up to debate as to whether they are required to be funded," Dismang said.

He said Hutchinson's proposed tax cut "seemed to be reasonable."

Sen. Bart Hester, R-Cave Springs, said in an interview that he still plans to press for enacting a tax cut of more than $100 million by the end of the next biennium on June 30, 2019.

In response, Hutchinson told reporters that if lawmakers cut more than $50 million a year, "we've got to have offsets with closing other tax loopholes or exemptions."

In fiscal 2018, the governor's proposed budget would increase general revenue for the Department of Human Services by $112.8 million, to a total of $1.55 billion. That includes a $75.5 million increase in Department of Human Services' grant budget, which includes the state's Medicaid program, to $1.14 billion, and a $26.7 million increase in the department's Children and Family Services Division budget to $118.2 million.

The state plans to finance its $100 million share of Arkansas' Medicaid expansion in fiscal 2018 with about $75 million in state general revenue and $25 million from insurance premium taxes, said state budget administrator Duncan Baird after the budget hearing.

For next year, Hutchinson is seeking a federal waiver for the program that provides health insurance to about 300,000 low-income Arkansans. The program will be called Arkansas Works. The state will begin paying 5 percent of the cost of the program on Jan. 1 and its share will gradually increase to 10 percent by fiscal 2020.

Hutchison also proposed using $90 million of the state's projected surplus of $229.4 million as one-time funding for the Medicaid program.

Sen. Bruce Maloch, D-Magnolia, said that if the Republican-controlled Congress and President-elect Donald Trump repeal the federal Patient Protection and Affordable Care Act and limit the Medicaid expansions among the states, "then we are going to be reworking quite a bit of this [proposed budget], aren't we?"

Baird replied, "If there are changes from the federal level that affect the program, we need to be able to respond to those, and so that will be something that we will be watching closely over the next few months."

Hutchinson said his proposed budget includes $50 million in savings at the Department of Human Services to help offset normal growth in the delivery of health care.

"We could not be successful in this budget and the savings if the rules to implement these reforms are not approved in a timely fashion by the General Assembly, and I am grateful for your cooperation as you proceed to review those rule changes to accomplish those savings," he said.

Hutchinson said his proposed budget would increase the Children and Family Services Division's general-revenue budget by $26.7 million in fiscal 2018 because the number of children in foster care is increasing at nearly 20 percent a year and the state can't shortchange these children. He also proposes allocating $14 million of the $229.4 million projected surplus for foster care in a supplement to this year's budget.

Hutchinson proposed a $3.9 million increase for the public school fund to $2.19 billion.

Maloch questioned whether the proposed budget would provide an adequate education for public school students.

Baird said the public school fund also receives money from the educational adequacy fund, financed with a 0.875 percent share of the state's sales tax, and "we could use those educational adequacy funds to meet the funding need based on the Senate [Education Committee] adequacy recommendation."

When figuring in both funding sources, the increase comes to about $60 million, Baird said.

Hutchinson said he's proposing allocating $100 million of the projected surplus for the state's share of public school facility funding.

"I hope that as we move to the future there will be a re-evaluation of those facility requirements because $100 million every biennium is really, really a lot of money and it is tough to make it match ... as you go through the budget line by line," he said.

Hutchinson proposed keeping the budget for two- and four-year colleges flat at $733 million in fiscal 2018 but said he plans to propose a $10 million increase in fiscal 2019 if the Legislature changes the funding formula for institutions to focus more on college graduation rather than enrollment levels. He also proposed using $6 million of the projected surplus on higher-education workforce grants and $5 million for the computer-science initiative.

He said he wants to devote $5 million in fiscal 2018 to support three crisis stabilization centers to help law enforcement personnel and first responders with the mentally ill.

Hutchinson's proposed overhaul of the state employees' pay plan would cost $30 million in general revenue in fiscal 2018, but he factors in $6 million in reduced expenses as a result of a reduction of more than 1,000 employees, or 4 percent, through attrition.

"Our current system locks good workers in at lower rates of pay, leading to high turnover, more retraining costs, and offers no incentive for advancement and good performance. The new pay plan will help us reward those higher performers and move our state toward a more professional, higher-achieving workforce," he said.

Hutchinson said his proposed fiscal 2018 budget also provides $3 million more for pre-kindergarten programs to provide more highly trained teachers and also restores $1 million a year in funding for libraries and senior-citizen centers that was cut last year

He said his plan doesn't set aside any money for legislative and the governor's General Improvement Fund projects because of needs ranging from foster care to education to public safety.

A Joint Budget Committee co-chairman, Sen. Larry Teague, D-Nashville, said the state is still about $23 million behind the forecast for net available general-revenue collections in the first four months of fiscal 2017.

"Is our thinking it will perk up, or are we just praying for a good Christmas?" he asked the state's chief economic forecaster, John Shelnutt.

Shelnutt said the first quarter was pretty unusual for corporate income-tax and for sales- and use-tax collections, and "we feel a little more confident" about corporate income-tax collections rebounding.

"I think the sales-tax numbers can recover compared to a really unusual performance in the first quarter," Shelnutt said.

Teague said he worried about the possibility of the state not having any surplus funds left over to spend at the end of fiscal 2017, making it difficult for the state to raise about $50 million a year to match $200 million in federal highway funding under the new federal highway law. State law requires 25 percent of future surpluses to go to highways and also devotes $20 million a year in interest earnings to highways.

"I guess our hope is that if we have an extraordinary Christmas and we can get ahead so we had some money to deal with some of those other issues," Teague said.

A Section on 11/10/2016

*CORRECTION: State fiscal 2018 starts July 1, 2017. The wrong start date was given in this article.