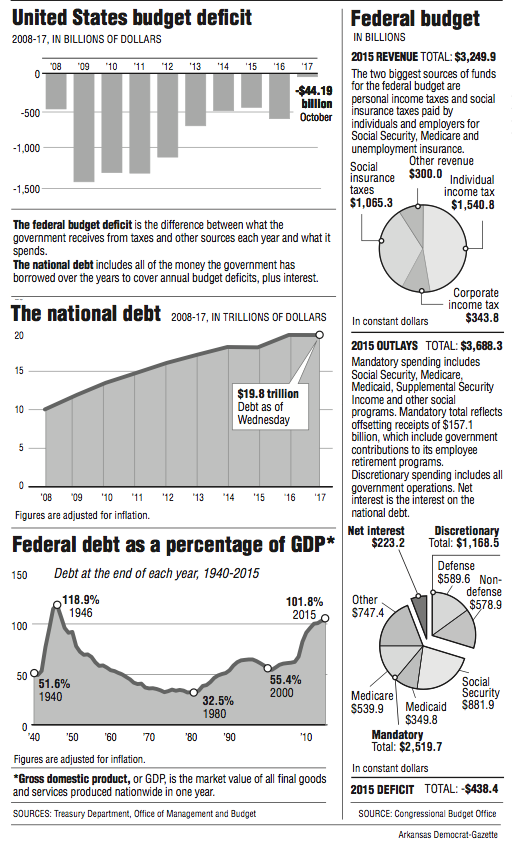

WASHINGTON -- The federal government began its new fiscal year with a deficit of $44.2 billion in October, a decrease from a year ago because the month started on a weekend.

Tax receipts collected by the government rose 5 percent from October 2015 to $221.6 billion last month, according to the Treasury Department. Expenditures by the government fell 24 percent from the same period to $265.9 billion, with the decrease largely coming from smaller Medicare and Veterans Affairs payments. Those particular outlays went out in September because Oct. 1 fell on a Saturday this year.

The budget deficit is estimated to total $600 billion in fiscal 2017. That would be up slightly from $587.3 billion last fiscal year, which ended Sept. 30. The federal government has run a deficit every October since 1955.

President-elect Donald Trump is expected to inherit a much sturdier economy than the one his predecessor, Barack Obama, carried into his second term four years ago. Back then, the scars of the 2007-08 recession were still fresh, with joblessness near 8 percent, wage growth was flat and Europe faced a grave debt crisis that threatened to spread across the Atlantic.

Today, the job market is seeing steady hiring, with unemployment currently at 4.9 percent. Wages are starting to rise, auto sales are near a record pace and housing is stronger. Europe's financial plight has stabilized.

Ethan Harris, chief global economist at Bank of America Merrill Lynch, said that if hiring remains solid and unemployment remains at historically normal levels, even tepid economic growth should manage to keep raising worker pay over the next couple of years.

But, the economy is not expected to strengthen. Growth likely won't rise much from its current listless pace of 1.5 percent to 2 percent a year, Harris said.

"There will still be a sense of disappointment in the economy for the average person, because growth isn't going to get any better," he said. "We've got to accept that 2 percent is good growth, not bad growth. That's the norm now."

Even so, the federal budget deficit could grow if Trump follows through with campaign promises of tax cuts for affluent Americans, particularly the richest 1 percent, and a much smaller tax cut for many others. Trump has proposed reducing the top bracket's tax rate from 39.6 percent to 33 percent. He'd end taxes on estates and repeal some taxes on investment income. The corporate income tax rate would sink to 15 percent from 35 percent.

Trump also wants to invest in roads, bridges and other infrastructure. Some economists are saying that such tax cuts and spending likely would boost growth in the short run but eventually would balloon the budget deficit by as much as $5 trillion over 10 years and potentially lift interest rates and shrink the overall economy.

Even without Trump's proposals, the federal budget deficit is expected to continue climbing as the population ages. The number of people 65 years or older is expected to increase nearly 40 percent in a decade, driving up spending on Medicare and Social Security.

Accumulating budget deficits add to the overall federal debt, which now totals more than $19.8 trillion. That figure includes about $5.4 trillion that the government owes itself, mostly from borrowing from Social Security Trust Funds.

Information for this article was contributed by Josh Boak, Bernard Condon and Paul Wiseman of The Associated Press.

A Section on 11/11/2016