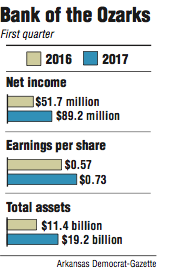

Bank of of the Ozarks posted a record profit of $89.2 million in the first quarter this year, a 73 percent increase from $51.7 million in the first quarter last year, the Little Rock firm said Tuesday.

Bank of the Ozarks is the largest bank in Arkansas with $19.2 billion in assets.

The bank earned 73 cents a share, beating the average estimate of 72 cents a share projected by 11 analysts surveyed by Thomson Reuters. That compared with earnings of 57 cents a share in the first quarter last year.

Bank of the Ozarks shares closed Tuesday at $49.42, down 40 cents, in active trading on the Nasdaq exchange.

The bank had total loans of $14.8 billion on March 31 and deposits of $15.7 billion. It has 250 offices in Arkansas, Alabama, California, Florida, Georgia, New York, North Carolina, South Carolina and Texas.

The largest portion of the bank's loans come from its real estate specialties group, which accounted for 70 percent of the funded balance of the bank's loans, George Gleason, chairman and chief executive officer, said in a conference call Tuesday.

The real estate specialties group is a Dallas-based division of Bank of the Ozarks that generates most of the bank's loans.

Bank of the Ozarks filed a report Tuesday with the Securities and Exchange Commission indicating that it is pursuing a reorganization of the bank.

If approved, Bank of the Ozarks no longer will have a holding company and will no longer be supervised by the Federal Reserve. Oversight from the state Bank Department and the Federal Deposit Insurance Corp. will continue.

"Today we have a holding company that owns 100 percent of the bank and really does nothing else," Gleason said.

Federal Reserve and FDIC oversight is a duplication, Gleason said.

"Of about 100 banks with assets of more than $10 billion, we understand that there are just a small handful of banks that do not currently operate [with] no Federal Reserve oversight," Matt Olney, a banking analysts in Little Rock with Stephens Inc., said Tuesday in a research brief.

The reason the firm wants to merge its holding company into the bank is that the elimination of the holding company will improve the bank's efficiency ratio, Gleason said.

Bank of the Ozarks had an efficiency ratio of 35 percent in the first quarter, one of the lowest in the banking industry. That means that it costs the bank $35 to earn $100.

The bank has a long-term goal of reducing its efficiency ratio below 30 percent, said Greg McKinney, the firm's chief financial officer.

The change will have to be approved by the state Bank Department and the FDIC. The Federal Reserve does not have to approve the change, Gleason said.

Bank of the Ozarks hopes to have the change implemented before the end of June, Gleason said.

The bank also is running out of space in its headquarters on Chenal Parkway, Gleason said.

Recently, the bank has made all of its double size offices into two offices, creating 60 to 70 more offices.

"But now we're essentially full," Gleason said. "We are jammed in at our headquarters."

About 60 employees have been moved to other space outside the headquarters building, Gleason said, and work will begin soon on its new headquarters on Arkansas 10 in west Little Rock. The bank acquired about 44 acres last year for the project.

"We expect to have an official announcement of that project in the next month or so," Gleason said. "We will move into that project in mid-2019."

Business on 04/12/2017