Arkansas state government's general-revenue tax collections nearly hit $525 million in July, beating expectations and setting a record for the month.

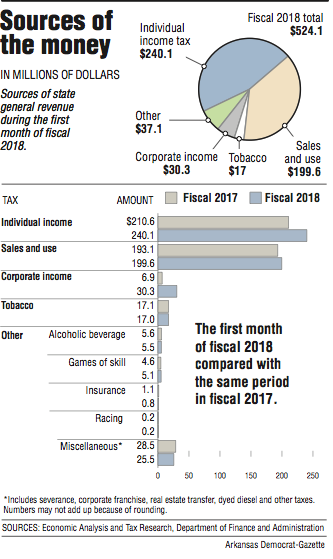

General revenue in July -- the first month of fiscal 2018 -- increased by $56.4 million over the same month a year ago to $524.1 million. The previous record was $470.8 million in July 2014. Compared with last July, sales and use taxes as well as individual and corporate income taxes had increased.

Fiscal 2017, which ended June 30, was a tumultuous time for state finances. Revenue seesawed above and below forecast, causing Gov. Asa Hutchinson to trim the $5.49 billion general-revenue budget for fiscal 2018 by $43 million.

"This report is a good start for the year," Hutchinson said in a statement Wednesday. "Our state's economy is strong, and its momentum is reflected in the revenue numbers. From last year's experience, we realize the month-to-month reports may vary significantly, but the state's economic trends are all positive."

Larry Walther, director of the state Department of Finance and Administration, said the first month's report of fiscal 2018 was positive, but it was too soon to say if the forecast would be changed.

Income taxes -- both individual and corporate -- were above forecasts for July. However, sales and use taxes continued to lag slightly behind expectations, even though they increased compared with the prior year. Individual income and sales and use taxes are the two biggest sources of tax revenue in Arkansas.

"Consumers are back and contributing in line with income growth, but it was below forecast because of motor vehicle sales," said John Shelnutt, the state's chief economic forecaster. "The retail portion of sales tax is on track again, I would say."

"It's always great to see gross receipts -- what they call sales and use -- bump up a little bit because that is the biggest part of the economy and as long as people are doing a little spending, then we can sleep for another 30 days," said Richard Wilson, assistant director of research for the Bureau of Legislative Research.

Nationally, states have regained much of their fiscal ground they lost during the recession, but have not fully rebounded, according to a July report from the Pew Charitable Trusts.

"The slow pace of tax revenue growth has left many with little or no wiggle room in their budgets. Nineteen states still collect less tax revenue than at their recession-era peaks, after adjusting for inflation, and most have a thinner financial cushion than they did before the last downturn," according to the report.

"In addition, 16 states' employment rates still clearly trail 2007 levels. Despite these challenges, personal income in all states has bounced back above pre-recession figures, though growth has fallen short of historic norms."

In Arkansas, unemployment is at a historic low, and tax revenue is above pre-recession levels.

However, in April, Hutchinson announced a $70 million cut to the $5.33 billion general-revenue budget, to $5.26 billion, for fiscal 2017.

He cited lagging sales tax and corporate income tax collections and higher-than-expected individual income tax refunds for the cut. The governor said services wouldn't be affected and employees wouldn't be laid off.

At the end of the fiscal year in June -- with a $15.7 million surplus -- Hutchinson restored all but $10 million of the budget cut announced in late April.

The state projected a decline of about $100 million in general revenue in fiscal 2017 from the 2015 Legislature's enactment of an income tax cut. Hutchinson had proposed cutting individual income tax rates for Arkansans with taxable incomes between $21,000 and $75,000 a year.

Earlier this year, the Legislature approved the governor's tax cut plan for those who make less than $21,000, but that doesn't go into effect until Jan. 1, 2019.

For this fiscal year, the Legislature and governor passed a $5.496 billion general-revenue budget, but the governor cut budgets by $43 million after the Department of Finance and Administration cut its tax revenue forecast in May.

Walther said the department would take another look at its forecast in late November and early December.

According to the finance department, July's gross general revenue came in 2.2 percent -- or $11.3 million -- above forecast.

It included:

• A $29.5 million, or 14 percent, increase in individual income taxes over the same month a year ago to $240.1 million, which fell $7.9 million, or 3.4 percent, above forecast. This July carried an additional payday, which explained the large increase relative to last year, officials said.

Payroll withholding tax grew by 15.8 percent year over year due in part to payday timing differences, according to the report.

"Part of the growth is attributable to payday timing differences, which means that disappears at some point later," Wilson said.

"It's nice to have a $10 million surplus after one month, but I imagine at some time in the future that partly disappears."

• A $6.5 million, or 3.4 percent, increase in sales and use tax collections over the same month a year ago, to $199.6 million. The monthly collection was $1.4 million, or 0.7 percent, below forecast.

Asked about online sales -- Amazon, the online retailer, voluntarily started collecting taxes on some products in Arkansas in March -- Walther said the department doesn't track those sales specifically.

"It's still an issue nationally and in Arkansas that there's a lot of sales that are being transacted that are not subject to sales tax," he said.

Amazon captured about 43 percent of online sales in 2016, according to Slice Intelligence, which tracks emailed receipts. However about half of the items sold on the site come from third-party sellers, according to company reports, and those items are not being taxed.

An Amazon spokesman declined to comment.

• A $23.4 million increase in corporate income tax collections over the same month a year ago to $30.3 million, which is $4.8 million above forecast.

Those three categories accounted for 88 percent of the gross general revenue in July.

Net general revenue available to state agencies increased by $53.8 million compared with year-ago figures to $454.5 million. Tax refunds and some specific government expenditures, such as court-mandated desegregation expenses, come off the top of gross general revenue, leaving a net amount that agencies are allowed to spend.

A Section on 08/03/2017