NEW YORK -- Homeowners suffering flood damage from Harvey are more likely to be on the hook for losses than victims of previous storms, in which many homeowners were compelled to purchase flood insurance.

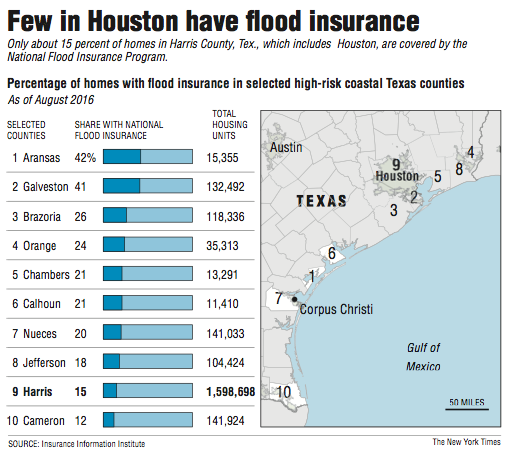

Insurance experts said that only a small fraction of homeowners in Harvey's path of destruction have the insurance, meaning that families with flooded basements, soaked furniture and water-damaged walls will have to dig deep into their pockets or take on more debt to fix up their homes. Some may be forced to sell, if they can, and leave their communities.

"All these people taken out in boats, they have a second problem: They have no insurance," said Robert Hunter, director of insurance at the Consumer Federation of America who used to run a federal flood insurance program.

Hunter estimated that total out-of-pocket costs for flooded homeowners could reach $28 billion, the largest in U.S. history.

Harvey made landfall in Texas late Friday as a Category 4 hurricane and has lingered off the coast, dropping heavy rain as a tropical storm. Hunter said he expects flood damage alone from the storm to cost at least $35 billion, about what Katrina cost. But in that 2005 hurricane about half of flooded homes were covered by flood insurance.

With Harvey, only two of 10 homeowners have coverage, Hunter estimates.

Homeowners insurance typically only covers damage from winds, not floods. For that, homeowners must buy separate coverage from the federally run National Flood Insurance Program. The insurance must be bought by homeowners with federally backed mortgages living in the most vulnerable areas, called Special Flood Hazard Zones.

People in those areas and near them have complained for years that the premiums are too high, though they would be much higher still if not subsidized by the federal government.

[STORM TRACKER: Follow Harvey’s projected path]

Much of the Houston area falls outside those most vulnerable zones, and many homeowners who aren't forced to have coverage have decided to do without. Now they are stuck because much of the damage in the nation's fourth-largest city won't be covered by their homeowners insurance.

Unlike Corpus Christi and Rockport, much of the Houston area was damaged by flooding, not winds.

"There's going to be a huge uninsured economic loss here," said Pete Mills, a senior vice president at the Mortgage Bankers Association.

About 1.2 million properties in the Houston-Sugarland-Baytown area are at high/moderate risk of flooding but are not in a designated flood zone requiring insurance, research firm CoreLogic said. That's roughly half of all properties -- residential and commercial -- in that area.

Hunter said homeowners without flood insurance can possibly apply for federal disaster relief benefits, but those come in the form of low interest loans, a burden for those already struggling with too much debt.

"If you have $30,000 in damages, you can get maybe $25,000," Hunter said. "But there will be interest, and then you have your mortgage. You'll have two loans on your house."

Homeowners with water damage can get paid through their homeowners insurance but only if wind blows out a window or sends a roof aloft first, allowing the water in. If the water rushes through the floorboard or walls, the insurance won't apply.

Harvey has dumped more than 50 inches of rain in some places, and rivers are swelling and expected to crest at record levels. The Cypress River, which runs through downtown Houston, is expected to rise 4 feet higher than the record 94.3 feet set in 1949, according to Air Worldwide, a risk modeling firm.

Loretta Worters, a spokesman for the Insurance Information Institute, said floods do have a least one positive effect: They persuade people who had ignored the risk to their homes to buy policies.

But the memory quickly fades, she said, noting that despite the blows of past major storms, only 12 percent of homeowners nationwide had flood insurance last year.

"People buy coverage immediately after a storm, then it starts to drop," Worters said. "Three or four years later, we're back to where we started."

RELATED ARTICLES

http://www.arkansas…">Houston lines up more shelter spacehttp://www.arkansas…">In Texas, Trump urges best ever disaster effort

A Section on 08/30/2017