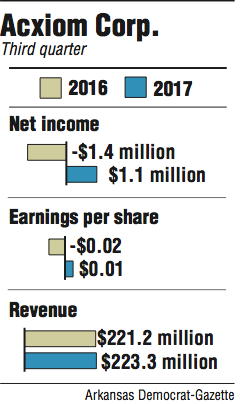

Acxiom Corp. reported $1.1 million in profit for its fiscal 2017 third quarter on Tuesday, reversing a $1.4 million loss in the same quarter in fiscal 2016.

It breaks down to 1 cent earnings per share for the quarter ending Dec. 31, 2016, reversing last fiscal year's loss of 2 cents per share. The adjusted earnings per share was 24 cents, 10 cents over analysts' consensus expectations, which Brett Huff, an analyst at Stephens Inc., called "a substantial beat."

The Little Rock company posted $223.3 million in quarterly revenue, about 1 percent more than last fiscal year's third-quarter revenue of $221.2 million. In an earnings call, Chief Executive Officer Scott Howe called it a "solid quarter" and said, "I really like our business momentum right now."

Acxiom is a data broker and distributor that helps marketers more efficiently advertise and target potential customers in a variety of ways.

"The upshot of the quarter was that we think Acxiom showed that all three of its segments grew very nicely, expanded margins very nicely and maybe more importantly, they raised their total company guidance, which should give investors some confidence," Huff said.

The company increased its earnings-per-share projection for the fiscal year by 10 cents per share, to 70 cents per share.

Acxiom's marketing services segment, which makes up nearly half of business, posted $101.2 million in revenue, down 13 percent from the same period in fiscal 2016. It works with specific companies to help them organize and consolidate their own customer data. The company blamed the decline on its September sale of Acxiom Impact, its email marketing business.

The company pointed out that LiveRamp's revenue grew about 60 percent.

Acxiom acquired LiveRamp, a San Francisco marketing services company, in 2014. In October, LiveRamp announced a new service called IdentityLink, which reportedly compiles data about customers from many sources to better enable companies to market across user platforms, a strategy known as omnichannel.

A month later, LiveRamp acquired two startup companies, Arbor and Circulate, for $140 million to add to IdentityLink's reach. At the time, the company stated the additions would "increase the scale of LiveRamp's omnichannel identity graph and network," particularly on mobile platforms.

Howe called the acquisitions "perhaps the biggest highlight of the quarter" and reported "two great teams of people" have been brought on from Arbor and Circulate.

Additionally, on Monday, LiveRamp made public a new partnership with LiveIntent, a marketing and advertising company focused on the email channel.

Continuing to expand its reach over customers across platforms, the company also announced Tuesday an expansion of an existing partnership with DataXu, a company that sells marketing software that automates the marketing process through algorithms and data optimization.

DataXu will now be able to license Acxiom's third-party data to advertisers and agencies for targeting, as well as in analytics models, said David Wells, senior sales director for audience solutions.

As the company said in the release, "Prior to this partnership, advertisers lacked the ability to engage consumers in a unified way across all the devices and media channels they use during the buying lifecycle. Now Acxiom and DataXu are partnering to connect the dots between the digital and TV worlds."

While the Little Rock company reported earnings after the Nasdaq exchange closed, shares were slightly up, at $26.10 on Tuesday.

Business on 02/01/2017