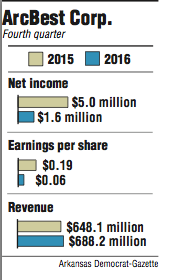

ArcBest Corp. reported a profit of $1.6 million for the fourth quarter on Wednesday, nearly 70 percent less than last year's report, reflecting the costs of the company's previously announced corporate restructuring.

The earnings beat analysts' expectations when adjusted for one-time charges, primarily $10.3 million related to the reorganization.

The company's earnings per share broke down to 6 cents versus last year's 19 cents per share on a profit of $5 million. When adjusted for one-time charges, the results came to 29 cents per share, 4 cents over analysts' average prediction. The company had warned in November that the restructuring would affect fourth-quarter earnings by about 22 cents.

The Fort Smith company grew revenue by about 6 percent for the quarter ending Dec. 31, bringing total revenue to $688.2 million compared with $648.1 million for the same quarter in 2015.

"When you exclude their nonrecurring costs, that are excluded in our adjusted, non-GAAP results, earnings were actually up on a year-over-year basis," said Brad Delco, transport analyst at Stephens Inc., with an abbreviated reference to generally accepted accounting principles. The company's adjusted profit for the quarter came to $7.6 million.

In November, the company announced it was merging almost all of its asset-light offerings under one ArcBest brand and unifying relevant sales departments, human resources and pricing structures. The restructuring, which resulted in 130 job cuts, accounted for $10.3 million costs in "impairment of software, contract and lease terminations and severance."

Judy McReynolds, ArcBest chairman, president and chief executive officer, reiterated in an earnings call that this was done because "our customers have been asking for integrated solutions from us and easier access to them."

The asset-light segment that experienced these changes posted a $0.9 million operating loss for the quarter, compared with a $3.4 million profit last year. Asset-light refers to the company's brokerage, expedited-shipping and moving businesses that use owner-operators and other equipment not owned by the company.

Total revenue for this segment grew 10 percent, however, keeping it around 30 percent of the company's total business. The company has previously stated that it plans to expand the segment to make up half of its revenue.

"Overall these results were better than our expectations," said Delco of Stephens Inc. "It's encouraging to see good progress being made on the asset-light side of the business, as this will drive improved returns on capital, which is a key metric for returning value to shareholders."

The asset-based division, which is ArcBest's less-than-truckload carrier, ABF Freight, made $7.1 million in profit, slightly down from last year's $7.7 million for the quarter. Total revenue also increased in this segment, by just under 5 percent to $482.1 million.

The company highlighted that while shipments per day grew by 6 percent, tonnage per day only increased about 1 percent. McReynolds attributed this to excess truckload capacity and a "strong uptick" in e-commerce and residential deliveries.

While these kinds of deliveries are more costly to handle and therefore more expensive for a customer, she said, "the good thing for us is that we've been doing that with our U-Pack business for about 20 years." U-Pack offers nationwide moving services using portable containers. McReynolds explained that ABF can leverage that experience and knowledge of the challenges of delivering in neighborhoods with regard to these kinds of shipments.

She would not disclose how much of their business comes from e-commerce and residential deliveries.

Delco said that because other less-than-truckload carriers have had improving weight-per-shipment rates, ArcBest's lesser rate stood out. However, he said, the company had the "strongest yield," a metric generally associated with price per shipment.

"This means they're getting adequate revenue from their shipments," he said. "So it appears they're getting a higher rate from more residential deliveries to accommodate what might be lost productivity from moving around lighter shipments."

In terms of results for the entire year, ArcBest took in $2.7 billion in revenue, up slightly from 2015. Net income for the year dropped nearly 60 percent from last year though, to $18.7 million. The company acquired Nevada-based Logistics and Distribution Services in September.

Shares trading on the Nasdaq exchange fell slightly Wednesday, closing at $30.70. In the past 52 weeks, shares have dipped as low as $14.85 and been as high as $33.95.

Business on 02/09/2017