FAYETTEVILLE -- Endowment assets supporting the University of Arkansas at Fayetteville rank 103rd in value among U.S. and Canadian institutions, a slide of three spots from last year, according to a report released Tuesday.

The endowment's $898.9 million market value as of June 30 was down 5.2 percent from a year earlier.

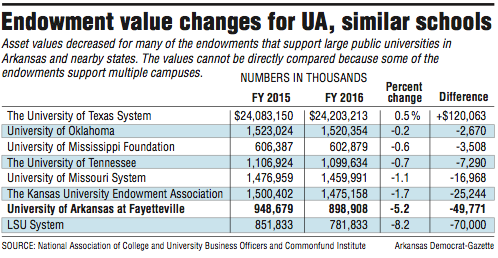

Many other schools also saw assets decrease in value, but most did not see as large of a dip.

Universities on average reported a 2.9 percent decrease in market value over the same 12 months to the National Association of College and University Business Officers and Commonfund Institute.

For schools with an endowment value between $500 million and $1 billion, the average decrease was 3.7 percent, according to an Arkansas Democrat-Gazette analysis of data from the report.

For UA, new endowed gifts didn't entirely offset investment losses, leading to a $49.8 million decrease in the market value of its endowment.

The University of Arkansas Foundation oversees investment of the university's endowment assets. The foundation's investments for the UA endowment resulted in a minus 2.1 percent net annualized return, according to a survey report released under the state's public disclosure law.

However, university spokesman Mark Rushing said UA reported a preliminary number in its survey response; endowment investments realized a net annualized loss of 1.5 percent rather than minus 2.1 percent.

Based on the survey, UA's investment return was slightly above that of similarly sized endowments. The report released Tuesday noted an average annual net return of minus 2.2 percent for investments of endowments from $501 million to $1 billion, based on information provided by participants in the survey. Some schools did not provide investment information.

Nationally, investors of endowment assets generally found low returns, said William Jarvis, executive director of the Commonfund Institute. For the 792 institutions reporting investment information, the one-year returns on average were minus 1.9 percent, net of fees.

"Returns for all of the investment categories were lower than the previous fiscal year," Jarvis said. He also called the 2.4 percent return average for fiscal year 2015 "very low."

Speaking generally about all colleges, the returns are a reason to worry, said John Walda, president and chief executive officer of the National Association of College and University Business Officers.

"The long-term viability and intergenerational quality with regards to the amount of money that's available in our endowments will be challenged," Walda said, also citing an uptick in spending from endowments.

For UA, approximately 5 percent of the endowment is paid out each year to cover expenses and for efforts like student scholarships and faculty support, according to the University of Arkansas Foundation.

The loss in endowment value for UA was greater than that seen for most of the endowments supporting peer institutions in nearby states.

The Kansas University Endowment Association's endowment lost $25.2 million in market value; the University of Missouri System endowment decreased by $17 million; the University of Tennessee endowment decreased by $7.3 million; and endowments for the University of Mississippi and the University of Oklahoma reported smaller losses.

Among endowments seeing greater drops in value was the LSU System endowment, which decreased in value by $70 million.

"We are thankful for all donor gifts including endowed gifts," Rushing said. "We will continue to solicit endowed gifts that will grow our endowment. That's a priority for our ongoing capital campaign, Campaign Arkansas."

The campaign's goal is to raise $1 billion, with more than $588.4 million raised so far.

Metro on 01/31/2017