WASHINGTON -- House Republicans unfurled a broad tax-overhaul plan Thursday that would touch virtually all Americans and the economy's every corner, mingling sharply lower rates for corporations and reduced personal taxes for many with fewer deductions for homebuyers and families with steep medical bills.

The more than 400-page bill, which entails the most extensive rewrite of the nation's tax code in three decades, is the product of a party that faces increasing pressure to produce a marquee legislative victory of some sort before next year's elections. GOP leaders touted the plan as a spark plug for the economy and a boon to the middle class. They christened it the Tax Cuts and Jobs Act.

President Donald Trump said Thursday in the Oval Office that the plan was to "give the American people a giant tax cut for Christmas." He added that the measure "will also be tax reform, and it will create jobs."

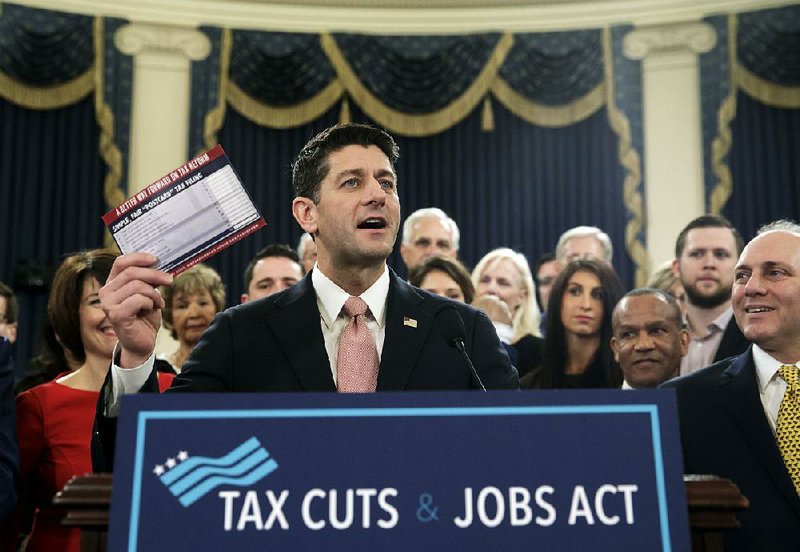

"With this plan, we are making pro-growth reforms so that, yes, America can compete with the rest of the world," said Speaker Paul Ryan of Wisconsin.

The plan also would increase the national debt, a problem for some Republicans. And Democrats attacked the proposal as the GOP's latest bonanza for the rich, with a phase-out of the inheritance tax and repeal of the alternative minimum tax on the highest earners -- certain to help Trump and members of his family and Cabinet, among others.

"If you're the wealthiest 1 percent, Republicans will give you the sun, the moon and the stars, all of that at the expense of the great middle class," said House Minority Leader Nancy Pelosi, D-Calif.

And there was enough discontent among Republicans and business groups to leave the legislation's fate uncertain in a journey through Congress that leaders hope will deposit a landmark bill on Trump's desk by year's end. Lawmakers scheduled the first official "markup" of the bill for Monday.

Underscoring problems ahead, some Republicans from high-tax Northeastern states expressed opposition to the measure's elimination of the deduction for state and local income taxes. And Senate Finance Committee Chairman Orrin Hatch of Utah called the House measure "a great starting point" but said it would be "somewhat miraculous" if its corporate tax rate reduction to 20 percent -- a major Trump goal -- survived. His panel plans to produce its own tax package in the coming days.

The House Republicans' plan, which took them months to craft in countless private meetings, represents the first step in their effort to reverse what's been a politically disastrous year in Congress. Their drive to obliterate President Barack Obama's health care law crashed, and GOP lawmakers concede that if the tax measure collapses, their congressional majorities are at risk in next November's elections.

The package's tax reductions would outweigh its loophole closers by $1.5 trillion over the coming decade. Many Republicans were willing to add that to the nation's soaring debt as a price for claiming a resounding tax victory, but others were wary of adding to the deficit.

While Senate Republicans were working on their own tax bill, Sen. Bob Corker, R-Tenn., lobbed a grenade into the House plan over its cost.

"As I have made clear from the beginning of this debate, it is my hope that the final legislation -- while allowing for current policy assumptions and reasonable dynamic scoring -- will not add to the deficit, sets rates that are permanent in nature and closes a minimum of $4 trillion in loopholes and special interest deductions," Corker said Thursday.

Republicans must keep their plan's shortfall from spilling over the $1.5 trillion line or the measure will lose its protection against Democratic Senate filibusters, bill-killing delays that take 60 votes to overcome. There are just 52 GOP senators, and unanimous Democratic opposition is likely.

BRACKETS DOWN TO 4

One of the key provisions of the tax bill telescopes the seven personal income tax brackets into four: 12 percent, 25 percent, 35 percent and 39.6 percent.

The 25 percent rate would start at $45,000 for individuals and $90,000 for married couples.

The 35 percent rate would apply to family income exceeding $260,000 and individual income over $200,000, which means many upper-income families whose top rate is currently 33 percent would face higher taxes.

The top rate threshold, now $418,400 for individuals and $470,700 for couples, would rise to $500,000 and $1 million.

The standard deduction -- used by people who don't itemize, about two-thirds of taxpayers -- would nearly double, to $12,000 for individuals and $24,000 for couples. That's expected to encourage even more people to use the standard deduction with a simplified tax form Republicans say will be postcard-size.

Many middle-income families would pay less, thanks to the bigger standard deduction and an increased child tax credit -- from $1,000 per child to $1,600. That credit would phase out once a family earns more than $230,000 a year, more than double the current $110,000 threshold.

But in exchange for the reductions, the plan eliminates breaks that millions of taxpayers have long treasured. Gone would be deductions for people's medical expenses -- especially important for families facing nursing-home bills or lacking insurance -- and their ability to write off state and local income taxes.

The bill also repeals tax credits such as a 15 percent credit for individuals age 65 or over or who are retired or on disability. Right now, those individuals can claim up to $7,500 for a joint return, $5,000 for a single individual, or $3,750 for a married individual filing a joint return.

The House bill also would repeal the adoption tax credit, no longer allow deductions for tax preparation and repeal credits for alimony payments. And deductions for moving expenses would no longer be allowed.

Led by Rep. Kevin Brady, R-Texas, chairman of the House Ways and Means Committee, the authors retained the deductibility of up to $10,000 in local property taxes in a bid to line up votes from Republicans from high-taxed states in the Northeast concerned about the fate of state and local tax deductions.

"It's progress, but I want more," said Rep. Leonard Lance, R-N.J., who represents one of his state's wealthier, higher-cost districts and wants the entire property tax deduction restored.

The plan will not, as many had feared, make any changes to the pretax treatment of 401(k) plans.

"Americans will be able to [continue to make] both traditional, pretax contributions and 'Roth' contributions in the way that works best for them," Republican lawmakers said in a primer on the bill.

MORTGAGE INTEREST

In another contentious change, the tax plan would slash the mortgage-interest deduction to the first $500,000 of the loan.

Under current tax law, Americans can deduct interest payments made on the first $1 million worth of home loans. The bill would allow existing mortgages to keep the current rules, but for new mortgages, homebuyers would be able to deduct interest payments made only on their first $500,000 worth of loans.

The National Association of Realtors, which has been wary of the tax plan, said that measure "appears to confirm many of our biggest concerns."

"Nobody knew that was in there," said Rep. Tom MacArthur, R-N.J. "They kept that from us," he said of House leaders, "and I don't appreciate that." He said he was "undecided" on the bill.

Among lobbying groups, too, the change to the mortgage-interest deduction has proved particularly contentious.

Some budget experts have said this change is necessary because otherwise the tax code essentially subsidizes the purchase of large homes in the wealthiest parts of the country. But housing groups have long fought off such a change, as the median home price in numerous parts of the country can be very high.

Jerry Howard, chief executive of the National Association of Home Builders, said his group would fight the bill "tooth and nail," claiming that it could lead to a decline in home prices and a housing recession.

"This now is a direct assault on the American dream of homeownership," he said.

Republicans said the changes are necessary to allow them to lower rates for all taxpayers. But many Democrats signaled opposition, vowing to fight its passage even while in the political minority.

"This bill is like a dead fish. The more it's in sunlight, the more it stinks, and that's what's going to happen," Senate Minority Leader Charles Schumer, D-N.Y.

CORPORATE RATES

On the business side, the House would drop the top rate for corporations from 35 percent to 20 percent. U.S. companies operating abroad would pay a 10 percent tax on their overseas subsidiaries' profits. Cash that those firms amass abroad but return home would face a one-time 12 percent tax.

U.S. companies have stockpiled as much as $3.1 trillion offshore, according to an estimate by Goldman Sachs in a recent research note. Under current law, the U.S. taxes multinationals on their global earnings, but allows them to defer taxes on foreign earnings until they bring them back to the U.S., or "repatriate" them.

The "deemed repatriation" tax imposed by the bill would clear the way for many of those companies to bring their earnings back to the U.S.

Also reduced, to 25 percent, would be the rate for many "pass-through" businesses, whose profits are taxed at the owners' individual rate.

But some of those companies would face higher rates. Sen. Ron Johnson, R-Wis., said that disparity was "just not acceptable," and the National Federation of Independent Business said it opposed the bill because it "does not help most small businesses."

The U.S. Chamber of Commerce praised the measure but said "a lot of work remains to be done." The group's chief policy officer, Neil Bradley, said pass-through businesses were one concern.

About two-thirds of the revenue cost in the tax bill would come from plans to slash business taxes, according to an analysis by the nonpartisan Committee for a Responsible Federal Budget. The group estimated that the overall cost would be enough to "cause debt to exceed the size of the economy by 2028."

Brady said the House plan had the "full support" of Trump and predicted that it would be on the president's desk this year. Anticipating the resistance from industry groups, Brady said, "We're going to prove them wrong once and for all."

Trump tweeted his optimism about the plan late Thursday.

"The lobbyists are storming Capital Hill, but Republicans will hold strong and do what is right for America!" he wrote.

Rep. Peter Roskam, R-Ill., a member of the Ways and Means Committee, said he was bracing for the lobbyist onslaught but would not be deterred.

"We've just finished the opening ceremonies of the lobbyist Olympics. My phone has all kinds of messages and there are all kinds of criticisms," he said. "The notion of just defending the status quo is insufferable, and we're not going to do it."

Information for this article was contributed by Alan Fram, Andrew Taylor, Zeke Miller, Kevin Freking and Mike Catalini of The Associated Press; by Jim Tankersley, Thomas Kaplan and Alan Rappeport of The New York Times; by Damian Paletta and Mike DeBonis of The Washington Post; and by Anna Edgerton, Erik Wasson, Lynnley Browning, Sahil Kapur, Kaustuv Basu, Laura Davison and Colleen Murphy of Bloomberg News.

RELATED ARTICLE

http://www.arkansas…">State's lawmakers see plan helping most Arkansans

A Section on 11/03/2017