It took one of the most powerful hurricanes in history to do it, but Home BancShares' streak of 25 straight quarters of record earnings ended Thursday.

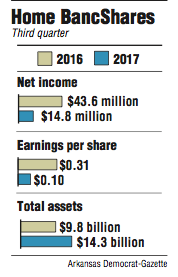

The Conway-based firm, parent company of Centennial Bank, posted net income of $14.8 million in the third quarter, down 66 percent from $43.6 million in the same period a year earlier.

Earnings per share dropped to 10 cents, down from 31 cents per share in the third quarter last year and missing the 34 cents per share projected in a survey of eight analysts by by business information firm Thomson Reuters.

Home BancShares closed at $24.96 Thursday, down 52 cents, in trading on the Nasdaq exchange.

Centennial had $10.5 billion in deposits, $10.3 billion in loans and $14.3 billion in assets in the third quarter.

The reason for the dramatic decline in earnings was that the bank took a $32.9 million provision for loan losses related to Hurricane Irma, setting aside money in a reserve fund for loans that could fail.

"While it's an ugly headline, we anticipate investors will look through the elevated [loan loss provision] expense and consider this a unique event," said Matt Olney, a banking analyst with Stephens Inc. in Little Rock.

Despite the unexpected decline in earnings, Olney maintained his buy rating on the stock.

The bank acknowledged that the total impact of the September hurricane on Home BancShares' financial condition may not be known for some time.

Home BancShares acted prudently from a conservative standpoint to take the provision for possible loan losses, said Garland Binns, a Little Rock banking attorney.

"It's obvious that the weather had a negative impact, primarily because a large portion of their facilities are in Florida," Binns said. "[The bank] can be commended for going ahead and [setting aside the provision for potential loan losses]. I suspect that Home BancShares will rebound in the fourth quarter since Hurricane Irma was a one-time occurrence."

A significant part of Home BancShares' South Florida market and customer base was harmed by Hurricane Irma, said Tracy French, chief executive officer of Centennial Bank.

Many of Home BancShares customers and employees lost their homes and several Centennial branches were damaged or destroyed, French said in a statement. Only one branch, in Naples, Fla., remains closed.

"Immediately after the storm passed, we secured our people and their families, ensured a safe working environment for our associates and focused our entire organization on serving our customers' needs," French said.

Soon after the hurricane hit Florida, John Allison, chairman of Home BancShares, flew there and toured the areas with Centennial branches. Early on, Centennial waived bank fees for customers in its markets and gave 90-day deferments on loan payments, Allison said.

At the time, Allison acknowledged that the bank likely would set aside money in a reserve for loans that could fail.

"It's been said that hurricane season brings a humbling reminder that despite technology, most of nature remains unpredictable," said Randy Sims, Home BancShares' chief executive officer. "But it's also been said that the one thing that Florida knows is how to deal with the aftermath of a hurricane."

On Sept. 26, Home BancShares closed its purchase of Stonegate Bank, which had $3.2 billion in assets, Home BancShares' biggest acquisition.

That leaves Centennial with 172 branches, compared with 147 in the second quarter this year. There are 89 branches in Florida and 76 in Arkansas, the first time Florida has had more Centennial branches than Arkansas, Sims said.

Home BancShares continues to consider acquisitions, Allison said. Outside of the current states where the bank is located -- Arkansas, Florida, Alabama and New York -- it still would consider expanding into Texas, Allison said.

Business on 10/20/2017