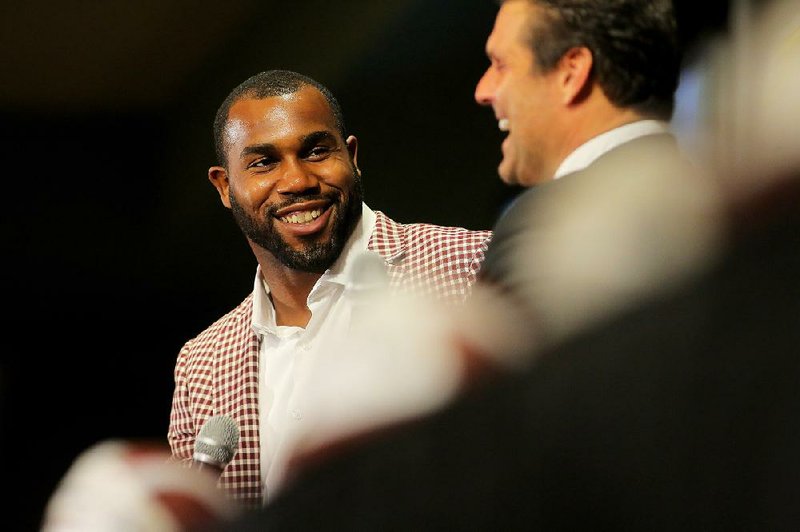

A judge on Thursday denied Simmons Bank's request to be dismissed from a lawsuit filed by Darren McFadden, a former football player for the Arkansas Razorbacks, the Oakland Raiders and the Dallas Cowboys who retired from football in late November.

Simmons was added last year as a defendant in the federal lawsuit McFadden filed in 2016 against his former financial adviser, Michael Vick of Little Rock, alleging that Vick defrauded the athlete of about $15 million while McFadden was starting out his football career. McFadden also added to the lawsuit Vick's wife, Carla, and two companies owned or controlled by Vick.

A jury trial in the case is set for Oct. 22, but both sides asked for a postponement Thursday.

The suit alleges in part that Metropolitan National Bank, which Simmons bought out of bankruptcy in 2013, facilitated the theft by failing to employ reasonable oversight procedures on McFadden's accounts.

In its motion to dismiss, the bank argued that in 2010, McFadden made Vick a signatory on McFadden's account, which provided Vick with the authority to engage in the monetary transactions challenged in the suit.

The bank also argued that in 2008, McFadden provided a power of attorney to Vick that authorized Vick to conduct a wide range of business and financial activities on McFadden's behalf. The bank contends that it was, consequently, required "to accept and pay without further inquiry any item ... drawn against" the account, until the bank received written notice that McFadden revoked Vick's authority, which didn't happen until May 2015.

McFadden's attorneys responded by saying the bank "clearly should have flagged $10.9 million in highly suspicious withdrawals and transfers," or at least contacted McFadden to ensure the activity was authorized. They want the bank to return funds from the unauthorized transfers.

In denying Simmons' motion to dismiss McFadden's claims of negligence and breach of contract, U.S. District Judge James Moody cited a federal rule requiring judges to allow plausible claims to proceed while drawing all reasonable inferences in favor of the plaintiff.

McFadden contends "that Simmons allowed Vick to fraudulently engage in a myriad of highly unusual, irregular and suspicious withdrawals," Moody wrote. He said McFadden also claims "that certain employees of Simmons had actual knowledge that withdrawals by Vick were unauthorized and fraudulent."

Moody said the facts are sufficient to support claims that the bank breached a fiduciary duty to McFadden, failed to notify McFadden of unauthorized transfers and owes a refund to McFadden.

Over 4½ years, McFadden's attorneys said, Vick made 982 withdrawals from the account "on an almost daily basis," in addition to wiring "millions of dollars" out of McFadden's accounts "without detection and without any suspicious activity reports."

Last year, McFadden filed two more federal lawsuits related to Vick's role as the player's financial adviser. One alleges that Vick fraudulently transferred real estate to his sister and her husband to hide his assets as a result of the first lawsuit. A jury trial in that case is set for Oct. 9 before U.S. District Judge Leon Holmes, but on Thursday, the parties jointly asked that it be postponed until after Jan. 1, 2019.

The other case, also assigned to Moody, accuses Ameriprise Financial Services Inc., for which Vick worked when he began managing McFadden's finances, of negligence and actively concealing Vick's manipulative actions. That case has been on hold since July 6, when Moody granted the parties' joint request to arbitrate before the Financial Industry Regulatory Authority.

Metro on 02/02/2018