Iron ore is starting to buckle after a series of warnings that prices are set to drop as global supply rises, and as investors fret about the potential impact of escalating trade tensions between the U.S. and China.

Benchmark spot ore eased to $62.50 a ton on Thursday, the lowest since November, according to Mysteel. In Singapore, SGX AsiaClear futures sank as much as 1.5 percent to $62.88 a ton, the cheapest since April 9, while the contract on the Dalian Commodity Exchange fell almost 4 percent last week.

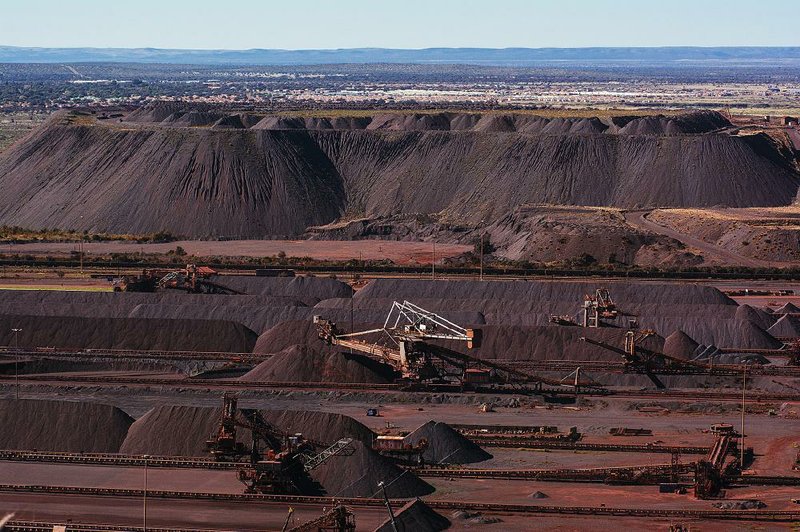

Since retreating into a bear market in March, iron ore has held in a narrow range in the mid-$60s as investors weigh robust steel production in top user China against prospects for increased mine supply. Last week, Australia, the world's largest shipper, forecast that prices will fall back into the $50s as output expands while China begins to reduce purchases. Lower prices reduce income for top miners Rio Tinto Group, BHP Billiton and Vale.

The "macro environment has been providing a key drag on sentiment with the looming trade tariffs," said Hui Heng Tan, a research analyst at Marex Spectron. That, coupled with both a period of lower demand and supply increases, means there's "a perfect storm in the making," Tan said.

Others expecting prices to ease include China's Orient Futures Co., as well as National Australia Bank. "Slowing steel demand in China should flow through into weaker demand for iron ore over the next few years," NAB said in a note. Prices are expected to drop toward $60 by the end of 2018, it said.

There are potential drivers for iron ore, including moves in China to redouble efforts to curb pollution. Recently, the State Council issued a three-year plan to tackle smog, tightening constraints on industrial production. In the past, similar measures have supported prices of premium iron ore products even as they mandated steel output curbs.

And Goldman Sachs said commodities are forecast to rise over the next 12 months as trade war concerns are overblown, although a note from the bank did not give an explicit outlook for iron ore. "The trade war impact on commodity markets will be very small, " it said.

SundayMonday Business on 07/08/2018