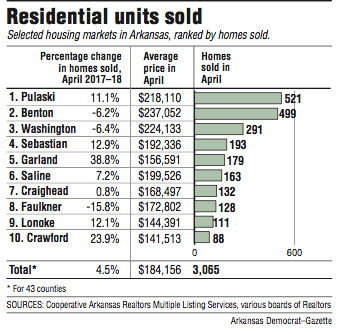

Home sales in Arkansas rose 4.5 percent in April, the Arkansas Realtors Association said.

The housing market in Arkansas continues to mirror the growth seen in 2017, said Mervin Jebaraj, director of the Center for Business and Economic Research at the University of Arkansas in Fayetteville.

Pulaski County Realtors sold 521 homes in April, the first time since May 2016 that more homes were sold in Pulaski County than in Benton County. Benton County recorded 499 home sales in April and Washington County was third with 291 homes sold.

Jebaraj said Monday that he doesn't pay much attention to which county sold the most homes every month.

In general, home sales in Benton County, Washington County and Pulaski County are keeping up with their normal trend of home sales, Jebaraj said.

There were 3,065 homes sold in April. For the first four months of the year, there were 10,631 homes sold, up 2.5 percent from 10,368 through April last year.

"It may not be the double digit gains we've seen in recent years, but we shouldn't expect that to continue forever," said Michael Pakko, chief economist at the Arkansas Economic Development Institute at the University of Arkansas at Little Rock.

It's surprising that this is the sixth year after the housing expansion began in 2012, which was the low point for sales "and the real estate market is still expanding," Pakko said.

Home sales in April were well in excess of the peak that occurred in the second round of home buyer tax credits in 2010, Pakko said. April 2010 was the closing month for the second round of the tax credits, Pakko recalled.

"That was an unusually strong April in the year 2010 with about 2,800 units sold," Pakko said. "And now, with an ordinary April, we're up over 3,000."

Bank of Little Rock Mortgage's business in April was consistent with the Arkansas Realtors Association's report for the same month, said Scott McElmurry, chief executive officer for the lender. Bank of Little Rock Mortgage is one of the larger mortgage lenders in the state.

"And I would say that May would be another increase, certainly based on the amount of business we've done," McElmurry said.

The average sale price in a 43-county area in Arkansas covered by the Realtors association was $184,156, up almost 7 percent.

"That is one of the strongest price growths since this time last year," Jebaraj said.

It isn't necessarily a good sign for home prices to increase by as much as 7 percent, Jebaraj said.

"It is more indicative of a low inventory of homes," he said.

Prices have been recovering ever since the recession, mostly in Northwest Arkansas, Pakko said.

The price gains are accelerating somewhat, Pakko said.

"That is perhaps an indication that demand is starting to put some pressure on prices," Pakko said. "The concern would be if it were starting to look like an inflationary increase. I don't think it is at this point."

Jebaraj and McElmurry agreed on the impact the lack of housing inventory is having on home sales in Arkansas and in the country. The lack of inventory isn't as bad in Arkansas as it is in the country, McElmurry said.

The low inventory of homes on the market affects prices, particularly in the state's metropolitan areas, Jebaraj said.

"It certainly doesn't help to see those price increases," Jebaraj said.

The interest rate on a 30-year fixed conventional mortgage varies from the high 4 percent range to the low 5 percent range, McElmurry said.

For a 15-year fixed rate loan, which is most often used by homeowners refinancing their loan, the interest rate is in the mid-4 percent range, McElmurry said.

McElmurry said he expects that the interest rate on a 30-year fixed rate loan will be in the 5 percent range by the end of the year.

Business on 06/05/2018