WASHINGTON -- U.S. economic growth accelerated in the first quarter on a big boost from inventories and trade that offset slowdowns in consumer and business spending, with President Donald Trump touting the report as much stronger than expected.

Gross domestic product expanded at a 3.2% annualized rate in the January-March period, according to Commerce Department data Friday that topped all forecasts in a Bloomberg survey calling for 2.3% growth. That followed a 2.2% advance in the previous three months.

The numbers may bolster hopes that growth is stabilizing after its recent soft patch, analysts said. Trump, speaking with reporters before departing on a trip on Air Force One, said the numbers were "far higher than the high expectations."

But underlying demand was weaker than the headline number indicated. Consumer spending, the biggest part of the economy, rose slightly above forecast at 1.2%, while business investment cooled. A Federal Reserve-preferred inflation measure, the personal consumption expenditures price index excluding food and energy, slowed to 1.3%, well below policymakers' 2% objective.

In recent years, the gross domestic product has been exceptionally weak in the first quarter. There had been fears growth could dip below 1% this year due to a variety of adverse factors such as the December stock market nose dive, rising weakness in key economies overseas, the U.S. trade war with China and a 35-day partial government shutdown that ended in January.

The data showing faster growth and tame inflation helped push Treasury yields lower Friday. U.S. stocks were little changed after paring earlier losses.

The first acceleration in gross domestic product since mid-2018 reflected the largest combined boost since 2013 for two typically volatile components -- inventories and trade -- that could weigh on the economy later in the year.

For a better gauge of the economy's health, analysts recommend focusing on a different number, which strips out trade and inventory effects as well as the effect of government spending. That measure, known as final private sales, came in at 1.3%, down from 2.6% in the fourth quarter of 2018 and the weakest showing since 2013.

"Domestic demand in the economy -- investment, consumer spending -- that was weak," said Ellen Zentner, chief U.S. economist for Morgan Stanley.

The recovery from the recession of 2007-2009 is currently the second-longest in history and will become the longest if it lasts past June.

But it has also been the slowest in the post-World War II period, a development economists attribute to slower growth in the labor force and weak gains in productivity.

Indeed, despite the robust gross domestic product figure, the underlying pace of economic growth has slowed since the middle of last year, when tax cuts and government spending briefly pushed the growth rate above 4%.

While 3.2% is a "great number," consumer spending "has to get stronger for the economy to remain in an expansion," said Michael Gapen, chief U.S. economist at Barclays PLC. "We think it will, but it's not a silver lining. Underneath the hood, household spending was soft and further expansion is going to require households to get back to a normal space of spending."

"The drivers of growth in the first quarter are unlikely to persist," said Gus Faucher, chief economist at PNC.

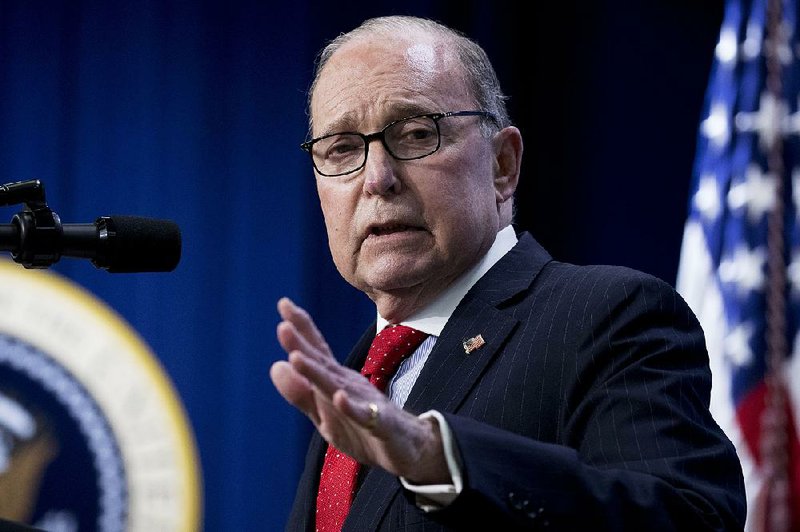

KUDLOW WEIGHS IN

But Larry Kudlow, head of the president's National Economic Council, said the administration is sticking with its estimate for growth above 3% this year.

Kudlow predicted that the income growth will lead to a rebound in car sales and also help lift housing, which has been struggling over the past year.

"I think the prosperity cycle is intact," Kudlow said in a CNBC interview. "I think the Trump policies are working to rebuild America and people are getting happier and happier."

The pickup in growth came despite the government shutdown through most of January, which subtracted 0.3 percentage point from the quarterly growth pace on the reduction in services. The Commerce Department said the closure also chopped the fourth quarter by 0.1 percentage point, while adding that the full effects can't be quantified.

Other recent reports have pointed to signs of strength, with March retail sales rebounding and a proxy for business investment rising sharply. U.S. stocks also rallied the most since 2009 in the first quarter and this month extended gains to a record, easing some concern about the durability of growth.

Fed policymakers next week are expected to hold interest rates steady while making adjustments to their characterization of the economy to reflect the firmer data.

At the same time, trade tension is fueling concern about the world economy, with the International Monetary Fund cutting its global growth outlook to the lowest since the financial crisis. Data this week showed world trade volumes falling the most since 2009 in the three months through February, while export-dependent South Korea saw its biggest gross domestic product contraction in a decade.

Friday's report showed net exports added 1.03 percentage point to growth while rising private inventories added 0.65 point. The combined boost of 1.68 point was the biggest in six years.

The report showed nonresidential business investment rose 2.7%, reflecting the third-straight decline in structures and a 0.2% advance for equipment spending that was the weakest since 2016.

Residential real estate was a drag on growth for the fifth-straight quarter, contracting at a 2.8% annual pace and subtracting 0.11 percentage point from the pace of gross domestic product gains, as housing starts and sales remained relatively sluggish. At the same time, the sector is starting to regain some steam amid lower mortgage rates and more-affordable properties.

Government spending, driven by state and local infrastructure building, reversed a decline in the prior period, growing at an annualized 2.4% pace that contributed 0.41 percentage point to the expansion, the most since 2017.

A further complication to interpreting the importance of the report is a statistical quirk known as residual seasonality, which has contributed to persistently lower economic readings in the first quarters of recent years.

The government has attempted to remedy the phenomenon. The consumer spending slowdown primarily reflected slower purchases of goods, notably light trucks, the Commerce Department said. The figures are less complete than a typical first gross domestic product report: Delays from the government shutdown mean analysts didn't have some consumer-spending data or merchandise-trade figures to factor into their estimates.

Information for this story was contributed by Reade Pickert, Jeff Kearns, Kristy Scheuble, Sophie Caronello, Shelly Hagan, Alyza Sebenius, Alister Bull and Justin Sink of Bloomberg News; by Martin Crutsinger and Deb Riechmann of The Associated Press; and by Ben Casselman and Jim Tankersley of The New York Times.

A Section on 04/27/2019