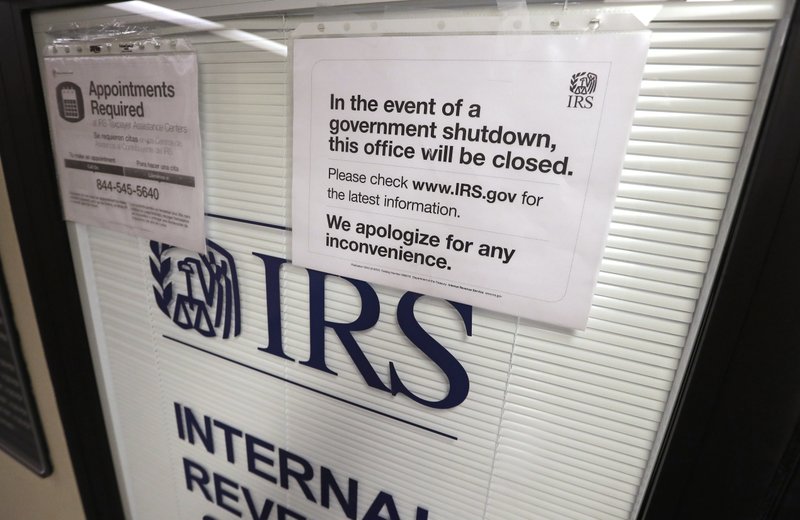

WASHINGTON -- Disruptions from last month's partial government shutdown caused a "shocking" deterioration in the IRS' telephone help for taxpayers in the first week of the filing season, the agency's watchdog said in a report released Tuesday.

In the week of Jan. 28, the official start of the tax season, Internal Revenue Service staff members answered only 48 percent of calls seeking help in filing returns, with an average wait time of 17 minutes, the report from the office of the National Taxpayer Advocate said. That compares with 86 percent of calls answered, and an average wait of four minutes, at the same time last year.

In addition, 93 percent of taxpayers who called during the last week in January to arrange installment tax payments were unable to speak with an assistant.

The difference between the two years "for levels of service and wait times for phone lines ... is shocking," the advocate, Nina Olson, wrote in her annual report to Congress. "These numbers translate into real harm to real taxpayers. The IRS will be facing tough decisions in light of the shutdown's impact."

The agency is reviewing the report and is "continuing to assess the impact of the shutdown on our various operations," the IRS said in a statement Tuesday. "The IRS is committed to continue making improvements across our information technology, tax enforcement and taxpayer service operations."

"The IRS successfully reopened operations following the shutdown, and the agency is seeing a good start to the 2019 filing season," the statement said.

The report flagged other problems at an agency that was already straining, even before the shutdown, from the burden of a complex new tax law, inadequate funding and antiquated computer systems. The IRS' workforce faced a backlog -- including 5 million pieces of mail to process -- when it returned to full strength Jan. 28 after the 35-day partial shutdown, which had furloughed most of its employees.

During the shutdown, President Donald Trump's administration made money available to pay hundreds of billions in refunds and ordered nearly 60 percent of the IRS workforce back to work without pay to handle tax returns and questions. Yet fewer than half of the recalled employees had returned to their jobs by the time the shutdown had ended, according to congressional and government aides.

The disruption raised the possibility of delayed processing of returns and refunds -- an annual check that about three-quarters of U.S. taxpayers typically count on. Lower-income households, especially, depend on refunds as their biggest cash infusion of the year.

The IRS has said that when taxpayers file electronically and use direct deposit to their bank accounts, roughly nine out of 10 refunds will continue to be issued this year in fewer than 21 days.

Still, anger is being vented on social media from people who have already filed their taxes and received smaller-than-expected refunds. Trump had pledged that under his tax-cut law, families would receive an average $4,000 tax cut. Most taxpayers did receive a tax cut. But because of how some workers had adjusted the amount of money withheld from their paychecks, to account for the complex tax changes, their refund has ended up smaller than they had anticipated.

The average refund paid in the first week of the filing season, which ended Feb. 1, was $1,865 -- down 8.4 percent from $2,035 in the same week last year -- according to the IRS. In her report, Olson did not address how the tax law or the shutdown might have affected refunds. But during the early part of the shutdown, no IRS employees were authorized to answer the phone lines, issue refunds, establish installment agreements with taxpayers or review pending agency actions.

Separately, New York Gov. Andrew Cuomo visited the White House on Tuesday to urge Trump to rethink a provision in the 2017 tax overhaul that Cuomo says is prompting a sharp decline in state revenue.

The Democratic governor met with the Republican president to discuss the $10,000 cap on the federal deduction for state and local taxes.

Cuomo said the cap is prompting wealthy residents to flee New York and is contributing to a recent drop of more than $2 billion in tax receipts.

Trump has praised the tax changes but said recently that he has heard it's causing problems for some New Yorkers. Residents in states such as New York, New Jersey and California could see substantial increases in their federal tax bills this year because of the deduction cap.

Prospects for new tax legislation that would expand or remove the $10,000 cap are weak, given the Republican majority in the Senate and concern over the potential for increasing the deficit without corresponding new revenue sources.

Democratic control of the U.S. House increases the likelihood that the cap could be repealed, Cuomo said. After returning to New York after the meeting, Cuomo said Trump "suggested he was open to a change."

"Because he understands: You hurt New York, you hurt California, you're hurting the economic engines of this nation," Cuomo said on WCBS Newsradio 880.

Information for this article was contributed by staff members of The Associated Press.

A Section on 02/13/2019