A bill passed by the Senate on Tuesday would allow changes in the wage base on which businesses pay unemployment taxes and also create a sliding scale according to the previous year's fiscal performance.

Senate Bill 298 -- sponsored by Sen. Kim Hammer, R-Benton, and Rep. Robin Lundstrum, R-Elm Springs -- could reduce the wage base from the current $10,000 down to $8,000 immediately, said Pamela Vance, assistant director of unemployment for the state Department of Workforce Services. Unemployment taxes go into the fund that unemployment benefits are paid from.

The Senate's 34-0 vote sends SB298 to the House for consideration.

"That's an immediate impact if this passes," Vance said.

In theory, Vance said, if the economy continues to stay on track, employers could, in the near future, only be required to pay unemployment taxes on an individual employee's first $7,000 in earnings.

[RELATED: Complete Democrat-Gazette coverage of the Arkansas Legislature]

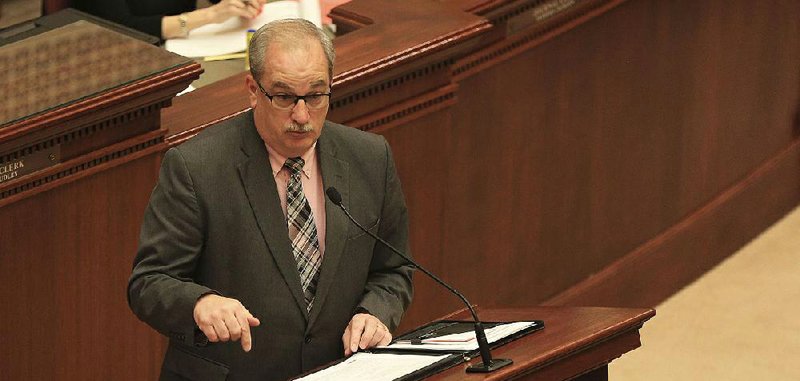

"Simply, what that means is in good strong economic times like we're enjoying right now here in the state of Arkansas, the percentage would be lesser to the employer, which means we'd be returning more money to the employer," Hammer told the Senate, adding that employers would be saved an estimated $44 million to $64 million if SB298 is implemented.

"Which is money back into the local economy so they can hire more people and they can do greater expansion of the business. This is really a solid, good piece of legislation brought by the department," Hammer said.

SB298 sets the wage base according to a sliding scale based on the unadjusted insured employment rate as reported by the U.S. Department of Labor.

Each year, the state's Workforce Department would evaluate the previous year's numbers and set the base for the next fiscal year, Hammer said.

If the economy falls, the scale would allow the wage base to go up automatically, without seeking legislative approval, to absorb the financial loss.

"They would reset it according to the sliding scale," Hammer said.

The sliding scale would also prevent an "all-at-once" increase if the economy starts to deteriorate, Vance said.

Arkansas' unemployment rate as of December was at 3.6 percent, or about 49,111 of the state's 1.35 million person work force, according to the Arkansas Department of Workforce Services.

As unemployment numbers rise, the state's unemployment fund takes a hit -- which led to the state borrowing $360 million from the federal government to keep the unemployment program afloat when the unemployment rate was above 7 percent between 2009 and 2011.

The state now has about $750 million in its unemployment fund today "because we're enjoying the robust economy," Hammer said.

"In my philosophy, why sit here and accumulate money into a fund that's solvent now?" Hammer said. "We have enough."

Politics on 02/20/2019