J.B. Hunt Transport Services Inc.'s second quarter results beat expectations, despite a one-time settlement charge.

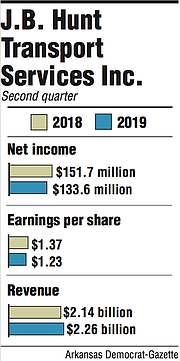

The Lowell-based transportation company posted net earnings of $133.6 million, a 12% drop from last year's $151.7 million.

During a time of rate and revenue-producing truck gains, the company said profits slid year over year because of higher driver wages and operational costs, including a one-time $20 million settlement charge worth 14 cents per share.

Revenue, including fuel surcharges, grew to $2.26 billion in the three months ending June 30, up from $2.14 billion.

Analysts had predicted J.B. Hunt would post earnings of roughly $1.34 per share, one cent lower than last year's quarter, according to a FactSet consensus estimate. Instead, the carrier posted earnings per share of $1.23. Without the one-time charge, earnings per share was an adjusted $1.37, beating Wall Street's and Stephens Inc.'s estimates, a research brief shows.

"Results were better than feared," said Stephens analyst Justin Long. All of the company's segments, except for logistics, beat Stephens' estimates. By segment: intermodal was 3 cents higher; dedicated was 7 cents higher; truckload was 1 cent higher, according to a research brief, and logistics was 6 cents lower than expected.

Long had predicted a weaker quarter compared to last year's because of flooding in the Midwest, a rush to complete freight shipments ahead of tariff deadlines and an overall softer-than-expected demand this Spring.

J.B. Hunt's intermodal, or freight, segment reported revenue of $1.1 billion and operating income of $124 million, outperforming its other segments for the quarter. It's dedicated, or fleet, segment reported revenue of $690 million and operating income of $60 million. It's truckload segment reported revenue of $99 million and operating income of $8.9 million. And it's integrated, or logistics, segment reported revenue of $334 million and an operating loss of $570,000.

The $20 million pre-tax charge used to settle a final mile claim was reflected in the company's dedicated segment.

Executives discussed the quarter's results in a conference call after market hours on Monday. A replay was to be made available on the company's investor website.

J.B. Hunt repurchased almost 2 million shares of common stock during the second quarter, worth $190 million. On June 30, the company said it had about $181 million remaining under its "share repurchase authorization," and 106.8 million actual shares outstanding.

Hunt shares fell 36 cents, or 0.4%, to close Monday at $92.58 before the earnings report was released. The shares have traded as high as $129.98 the past 52 weeks and as low as $83.64. The shares rose as much as 7% in after-hours trading.

Business on 07/16/2019