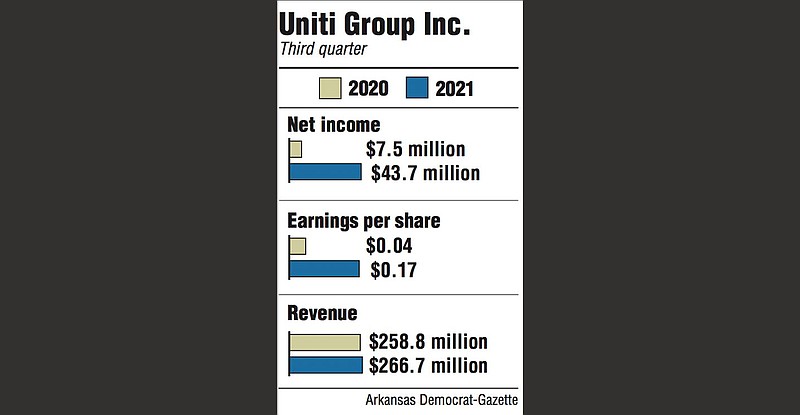

Uniti Group Inc. reported strong gains in profitability Thursday as third-quarter net income jumped to $43.7 million from $7.5 million in the same quarter last year – a nearly 500% bounce attributed to customers expanding their communications networks.

Earnings per share increased more than 300%, up to 17 cents from 4 cents in 2020. Total revenue was up 3% to $266.7 million for the quarter ending Sept. 30 compared with $258.8 million generated in the same period a year ago.

Uniti's leasing and fiber businesses "continue to perform exceptionally well," powered by strong customer demand that "led to one of the highest quarters ever for consolidated bookings," President and Chief Executive Officer Kenny Gunderman told analysts on a call Thursday morning. Earnings results were released before the stock market opened.

The company, a real estate investment trust, said it had funds from operations of $109.9 million, or 43 cents per share, crushing the Zacks estimate of 37 cents per share. However, revenue was off by 1.63% from the Zacks consensus.

Uniti said consolidated bookings, essentially new sales across all operating units, reached $1 million in monthly recurring revenue for the second consecutive quarter. Growth was "fueled by continued tailwinds within the communications infrastructure industry and strong demand for our fiber infrastructure," Gunderman said Thursday.

Business has increased with multiple customers across sectors, including wireless carriers, enterprise, government, education, healthcare, financial institutions and other large national strategic accounts, the company said.

Uniti's customers are investing to expand 5G networks, 10-gigabit upgrades and deployment of small cellular sites, which provide higher data speeds within a shorter range. Demand for 5G wireless networks helps Uniti because the providers rely on fiber to deliver data to the towers and back to customers.

"These investments provide Uniti with the unique opportunity to expand our networks with anchor economics, setting the foundation for attractive future lease-ups and further validating the shared infrastructure benefits of fiber," Gunderman told analysts on the call.

Even with the growth spurt, there are still opportunities ahead, Gunderman said, noting that the company has 3 million strand miles of fiber available for leasing to third parties "making us one of the largest players in the wholesale fiber market."

The executive team is also working with Uniti's board to evaluate how to separate the company's assets and create greater value. "We're spending time with our board evaluating and refining analysis that would allow us to separate our assets in a tax and value efficient manner," Gunderman added.

Last month, the Wall Street Journal reported that Uniti was the target of a potential acquisition by Zayo and private equity investors who also were reported to be interested in acquiring Windstream Holdings Inc. and recombining the two Little Rock companies. The Journal reported talks were stalled over the price for Uniti.

On Thursday, Gunderman repeated the company's belief that there is a big difference in how public investors value Uniti versus how the company is valued by private equity.

"Our ongoing discussions continue to reinforce these things," Gunderman said on the call. "To be clear, we are focused on executing our strategy of growing our business organically and executing on bolt-on M&A. But we've proven to be smart buyers and sellers and we are open minded to all paths that maximize shareholder value."

Uniti began operations in 2015 as a spinoff from Windstream, which turned over its fiber network to Uniti. Windstream leased part of its network from Uniti and has remained the company's largest customer since the spinoff.

Uniti has the eighth-largest fiber network in the nation and is the third-largest independent operator.

Uniti shares are up 21% since the beginning of the year, slightly below the S&P 500's gain of 24%. The Dow Jones Industrial Average is up about 18%. Uniti shares closed Thursday at $13.90, down about 2.25% for the day.